Italy may have another election as soon as this September as Italian President Sergio Mattarella rejected the Finance Minister picked by the coalition formed after election results a few weeks ago. Initially, Luigi Di Maio, the leader of the Five Star Movement, and Matteo Salvini, the leader of the Northern League, ruled out a coalition. After it became clear that no party could form a government, both parties joined forces in order to implement the change the majority of Italian voters asked for. The idea of a populist government in Rome send the Euro tumbling and Italian bond yields soaring.

According to the Italian constitution, the President has to approve the Prime Minister as well as all other major ministers. Usually the President first appoints the Prime Minister and then accepts the PM’s choices. President Mattarella stated that he approved all appointees with the exception of Finance Minister Paolo Savona, a euroskeptic economist who doesn’t like Germany and the influence it yields in the Eurozone and especially in Italy and its financial system.

Ratings agencies threatened a cut to Italy’s ratings if a populist government will be allowed to govern. Germany and the EU echoed concerns with the choice if the Italian voters. Neither can afford another loss after Brexit, especially with countries like Hungary, Poland and the Czech Republic seeing a rise in anti-EU sentiment from voters and politicians alike. The loss of Italy may be too big for the EU to handle. After rejecting the Five Star Movement/Northern League coalition government, President Mattarella asked former IMF Executive Director Carlo Cottarelli to form an interim government.

The Euro came under new pressure and extended its slide after the Five Star Movement, the Northern League and Forza Italia, former Prime Minister Silvio Berlusconi’s party, already rejected Cottarelli. The Euro has now dropped to the lower band of a very strong horizontal support area, will this level hold or is bearish sentiment strong enough to force a breakdown and a continuation of the slide? Open your PaxForex Trading Account today and access the wonderful world of forex trading!

President Mattarella gave in to pressures from ratings agencies, the EU and Germany and decided against the vote of Italian voters. Di Maio is said to ask for the impeachment of Mattarella for ignoring the democratic wish of Italians. He also asked voters to mobilize and stated ‘I call on citizens to mobilize, make yourselves heard.’ Salvini agreed and asked for protests across Italy this week. A big demonstration may be organized in Rome on June 2nd, the birthday of Italy’s republic after World War II. Can the Euro deal with Italy? One thing is for certain, more uncertainty and volatility are ahead for the global financial system and here are three forex trades every traders should add right now.

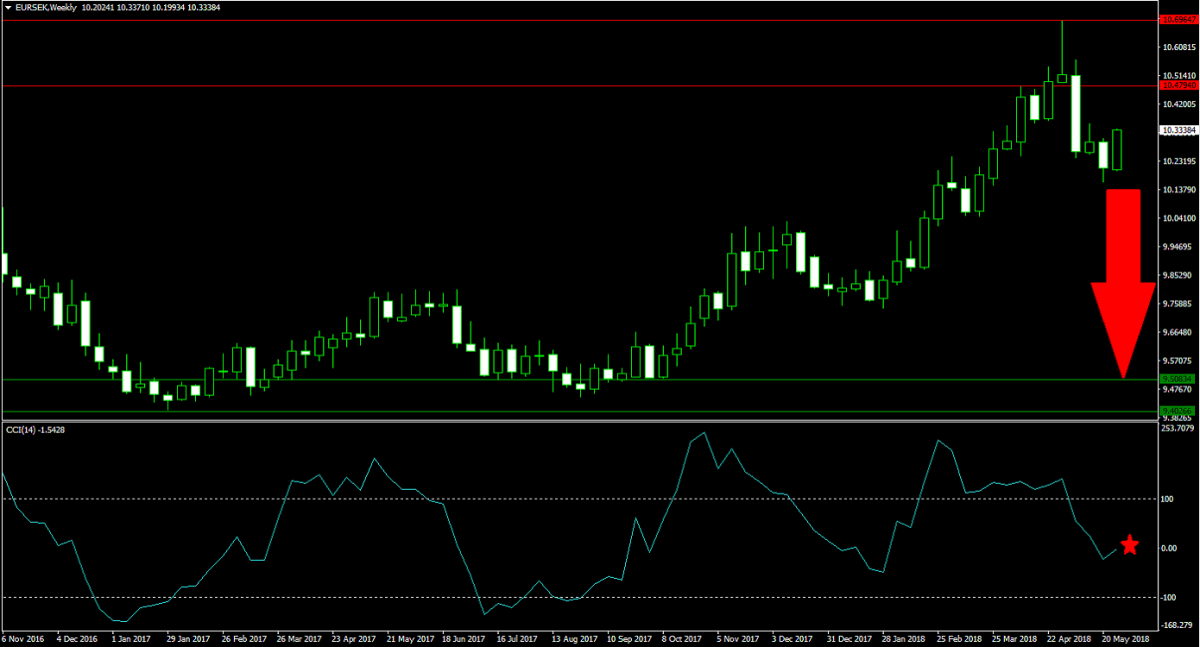

Forex Profit Set-Up #1; Sell EURSEK - W1 Time-Frame

This currency pair has already broken its strong uptrend with the collapse of price action below its horizontal resistance area. Bearish sentiment is now on the rise and forex traders should expect more downside in the EURSEK. Unlike major currency pairs, minor pairs associated with the Euro have not yet moved to the same extend and some are bound to catch-up. Selling any potential rallies in the EURSEK is advised in order to capture the attractive downside potential in this currency pair.

The CCI has pushed below 100 and bearish momentum was sufficient to extend the slide into negative territory. This attracted more sell orders as this technical indicator is bound to retreat further. Follow the PaxForex Daily Forex Technical Analysis section and get the most profitable technical trading set-ups delivered directly into your inbox.

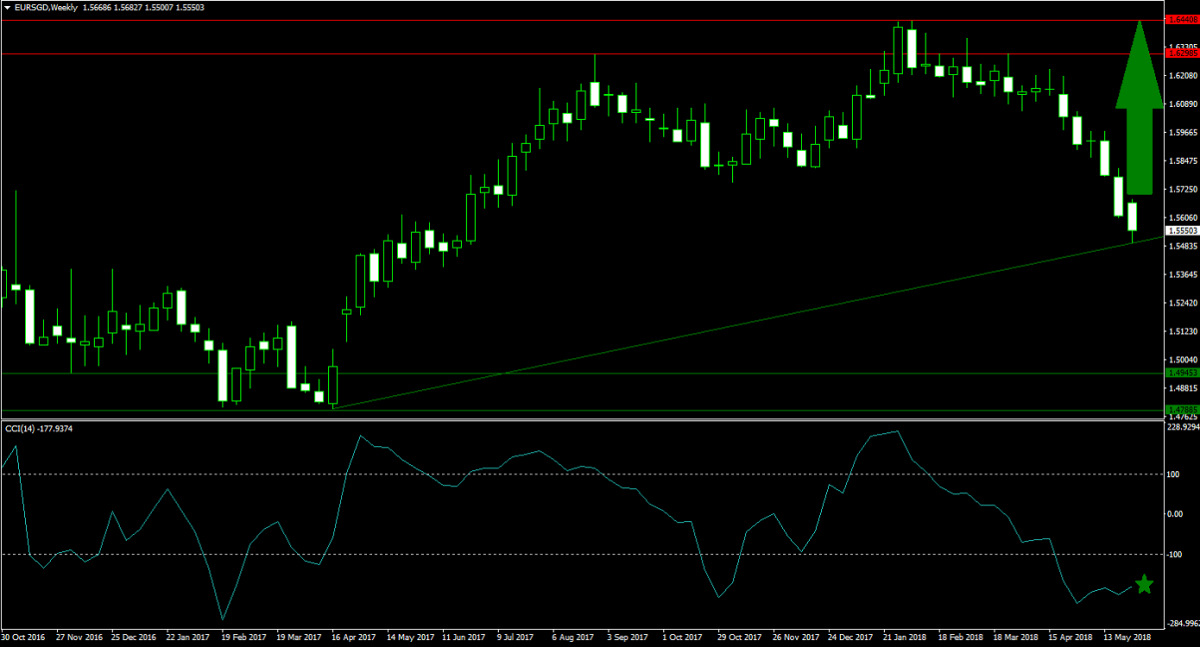

Forex Profit Set-Up #2; Buy EURSGD - W1 Time-Frame

The contraction in the EURSGD may be exhausted after price action descended from its horizontal resistance area until it met its ascending support level. Bearish pressures are receding and as support levels hold, bullish sentiment is on the rise. This could lead to a short-covering rally in the EURSGD and propel this currency pair back into its horizontal resistance area. Forex traders are recommended to buy the dips into its ascending support level.

The CCI is trading deep in extreme oversold conditions, but has ascended from its lows. A move above -100 could result in the addition of more buy orders and result in a further increase in bullish pressures. Download your PaxForex MT4 Trading Platform now and enter this currency pair to your global forex portfolio.

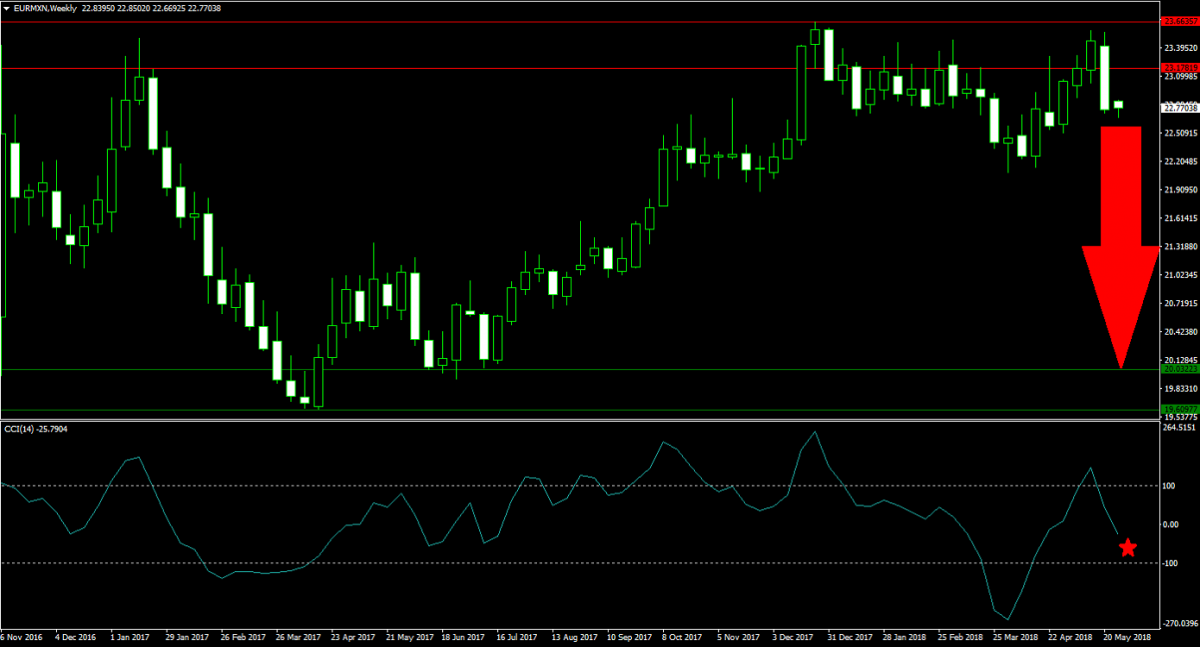

Forex Profit Set-Up #3; Sell EURMXN - W1 Time-Frame

Following two failed breakout attempts above its horizontal resistance area, the EURMXN is under an increase in bearish pressures. Price action just completed a breakdown from where more downside should be expected. With limited support levels, this currency pair should be able to accelerate to the downside until it can challenge its horizontal support area. Forex traders should sell the rallies into the lower band of its horizontal resistance area.

The CCI, a momentum indicator, briefly spiked into extreme overbought territory but quickly reversed and collapsed below the 0 mark. Forex traders should expect more downside from current levels. Subscribe to the PaxForex Daily Fundamental Analysis in order to get each trading day’s most profitable fundamental trading set-ups; earn over 500 pips per month with the help of our expert analysts!

To receive new articles instantly Subscribe to updates.