The 751-member European Parliament will vote tomorrow if it should trigger Article 7 of the EU Treaty against Hungary. Last year the European Commission recommended using Article 7 against Poland, but it has never been used before. It is a mechanism intended to force EU member countries who disagree with the EU to drop their opposition or risk losing their voting rights inside the EU. While on paper it claims that Article 7 is intended to maintain democracy in the world’s largest trading bloc, forcing a country who disagrees with its policies back in-line is everything but democratic.

The timing of this should not be forgotten, the European Parliament faces elections next year and with populists on the rise the establishment will not give up seats without a fight. Since a unanimous vote is required to punish a member state, neither Hungary not Poland are at risk to face sanctions or a suspension of their vote as both countries agreed to veto such a move. What many seem to forget is that what is required for countries like Germany and France, who essentially dictate the EU, differs from what other member states need. How will the Euro handle political imbalances in the bloc?

Hungary and Poland don’t have the Euro, but Italy is in the same camp and home to the first populist government in the Eurozone. Sweden just joined the ranks this past weekend by voting for populism. The Netherlands barely avoided a populists government and the UK is leaving the bloc after triggering Article 50, something never done before. Even Bulgaria almost voted in a government which is anti-EU. The Czech Republic is home to another populist leader and so is Austria. Slovenia is joining the ranks as well which shows that the Franco-German alliance is not as stable as the Euro needs it to be.

Can the Euro afford Article 7? The last time an EU Treaty article was triggered, the EU lost the UK. What may happen if the EU Parliament triggers another article for the first time? Uncertainty could result in forex traders taking a closer look at the Euro, the Hungarian Forint and the Polish Zloty. Open your PaxForex Trading Account now and access the forex market in order to position your portfolio for a profitable trading outcome.

Just how divided the EU is will become visible next year with many analysts predicting a showdown between the establishment and the populist. The winner will get to pick the next European Commission head who will dictate the direction the EU will take over the next few years. Hungary, Poland and Italy are fighting for sovereign rights and others may join in as being a member of the EU has its disadvantages. Leaders around the bloc, and by extension the citizens of the EU who voted for those leaders, are starting to question the EU project with good reason. Can the Euro afford Article 7? Volatility ahead should be expected and here are three forex trades for this late summer to consider.

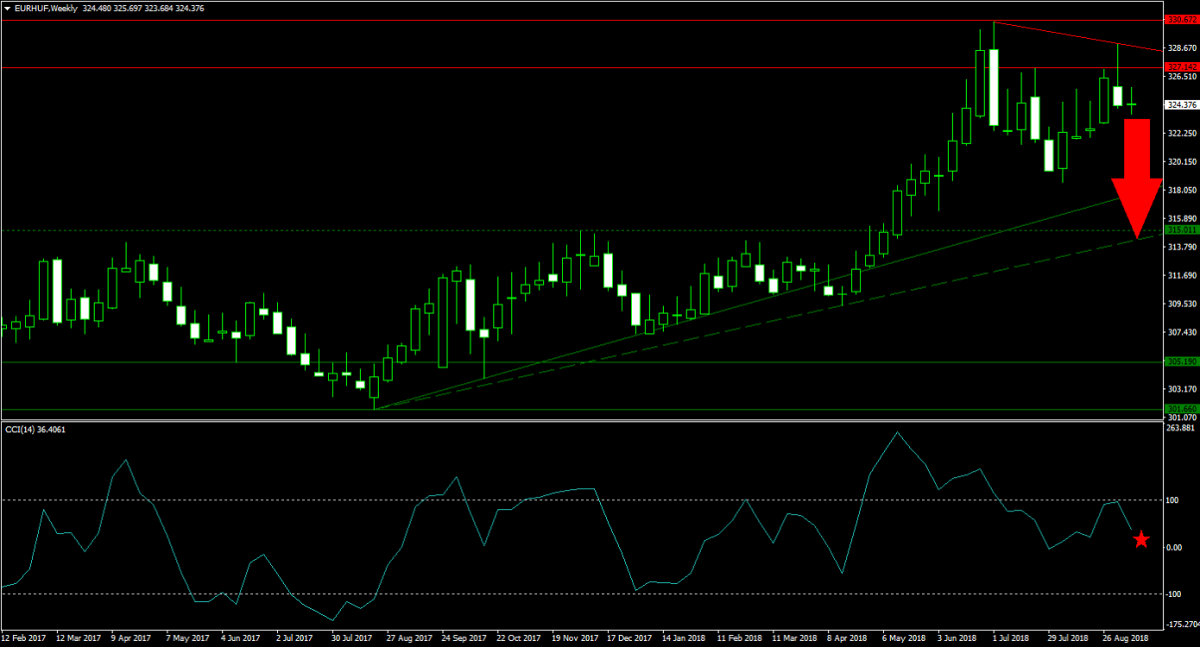

Forex Profit Set-Up #1; Sell EURHUF - W1 Time-Frame

This currency pair already completed a breakdown below its horizontal resistance area and rejected a second attempt. Bearish sentiment is accumulating and the primary descending resistance level is adding to selling pressure in the EURHUF. Price action is poised to contract through its primary ascending support level and down into its next horizontal resistance level which is being intersected by its secondary ascending support level. Forex traders are advised to sell the rallies in the EURHUF from current levels into the lower band of its horizontal resistance area.

The CCI has confirmed the rise in bearish momentum and descended from extreme overbought conditions. A push below the 0 mark is expected to further accelerate selling pressure in this currency pair. Download your PaxForex MT4 Trading Platform today and start building your profitable forex portfolio with the help of our expert analysts. Take the first step today and plant the seeds for a successful future.

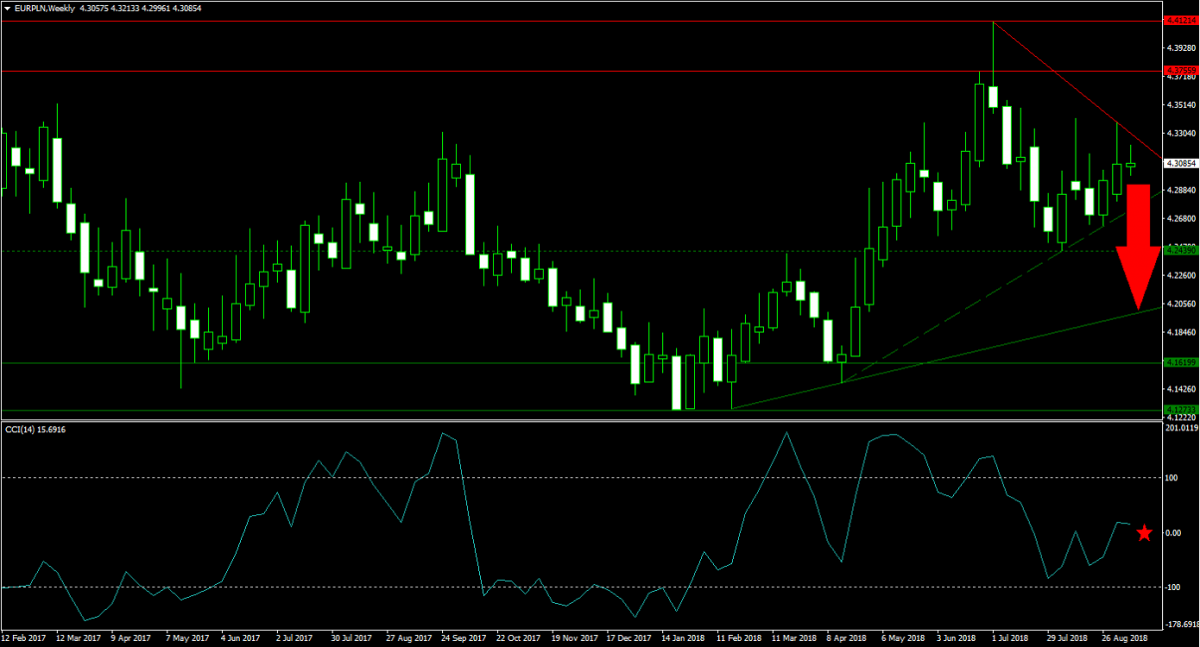

Forex Profit Set-Up #2; Sell EURPLN - W1 Time-Frame

The EURPLN is at a more advance state of capital allocation back into Poland and out of the Eurozone. This currency pair has dropped from its horizontal resistance area into its next horizontal support level from where it was able to bounce into its primary descending resistance level. Price action is now trapped below it, but above its secondary ascending support level from where the EURPLN is anticipated to complete a breakdown into its primary ascending support level. Forex traders are recommended to spread their sell orders inside this triangle.

The CCI is trading just above the 0 mark, but bearish momentum in this technical indicator is increasing and expected to force a move below it. This is expected to trigger a new wave of sell orders in this this currency pair. Subscribe to the PaxForex Daily Forex Technical Analysis and never miss out on a profitable trading opportunity. Just enter the technical trading set-up into your own forex trading account and relax.

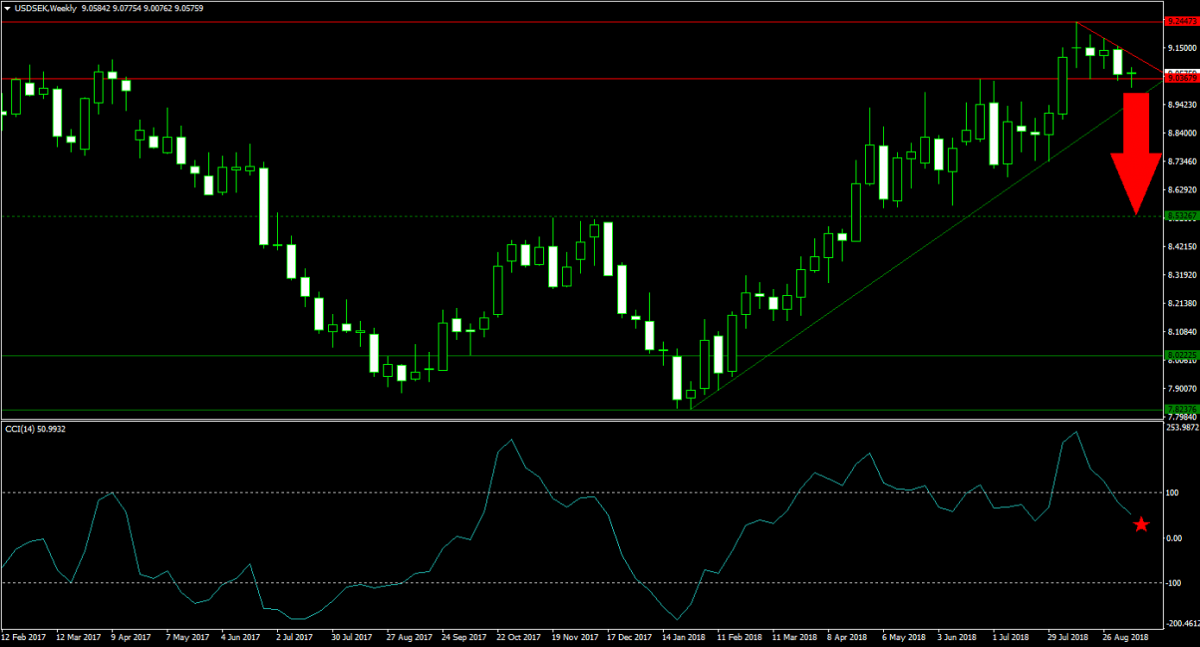

Forex Profit Set-Up #3; Sell USDSEK - W1 Time-Frame

With bearish sentiment on the rise, inspired by an increase in the desire to take profits following a strong advance, the USDSEK is on the verge of completing a breakdown below its horizontal resistance area. Price action is trading just above the lower band and is trapped between its primary descending resistance level and its primary ascending support level. The USDSEK is expected to reverse direction until price action can challenge its next horizontal support level. Forex traders should place their sell orders just above the lower band of its horizontal resistance area.

The CCI already moved out of extreme overbought territory and is on its way to push below the 0 level which would result in a bearish momentum change and signal more downside in this currency pair. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide your trading account through the forex market. Earn over 500 pips per month just by following our trading recommendations.

To receive new articles instantly Subscribe to updates.