While many analysts fret over the US Federal Reserve and if or when they will cut interest rates, many tend to ignore the Canadian Dollar and its 4% rally this year. The Canadian Dollar is a commodity currency due to its heavy dependence on commodity exports. This is the reason why the rally this year is even more impressive as during a global economic slowdown, demand for commodities remains depressed which results in lower prices. Usually commodity currencies face selling pressure during economic slowdowns, but the Canadian Dollar has defied bearish pressures and carved out a bright spot.

One key bullish factor for the Loonie has been the Bank of Canada under the helm of Governor Poloz which so far has refrained from interest rate cuts. This resulted in Canada being home to the world’s best performing currency, but this may start to create other problems for the Canadian economy at a time competitors favor a weak domestic currency in order to make exports cheaper. The Canadian consumer is carrying a heavy debt load and is unable to support an economic expansion which means that the export sector is expected to cover the slack.

Forex traders and analysts will now focus on the next Bank of Canada meeting in order to get more clarity on future monetary policy. Will the central bank tolerate a stronger currency or will it attempt to meddle in the forex market by cutting its interest rate in order to prevent an extension of the rally? The Head of Interest Rates strategy at the Canadian Imperial Bank of Commerce, Ian Pollick, noted “At some point, you still have to face that reality where this eventual hand-off or rotation away from households and consumption to exports and investment is not forthcoming and a stronger currency really restricts that even more.”

The last time the Bank of Canada commented on the forex market was in October of 2017 after a strong rally in the Canadian Dollar and the impact on the economy? Will Poloz join the pressure other central banks feel and announce a more accommodative monetary policy moving forward? How will this impact forex trading? Open your PaxForex Trading Account now and join our fast growing community of profitable forex traders who earn more pips per trade!

The other possibility would be the acknowledgement of a strong economy which is pushing the currency higher. The Canadian GDP surprised to the upside as the US is moving in the opposite direction. Inflation is also near the 2% target which shows an overall healthy economy able to support the rally in the Canadian Dollar, especially of the central banks refrains from cutting interest rates. Markets are currently pricing in one 25 basis point rate cut over the next twelve months after hiking interest rates five times since 2017. The Chief Economist at Manulife Investment Management, Frances Donald, added “We’re in what I’m going to call a resilient pocket where Canada can look a lot better than the rest of the world, at least in the foreseeable future.” Finally, the central bank could highlight global growth concerns and dampen the outlook for future interest rates hikes. Can the Canadian Dollar rally last? Here are three forex trades for lasting pips in your forex portfolio!

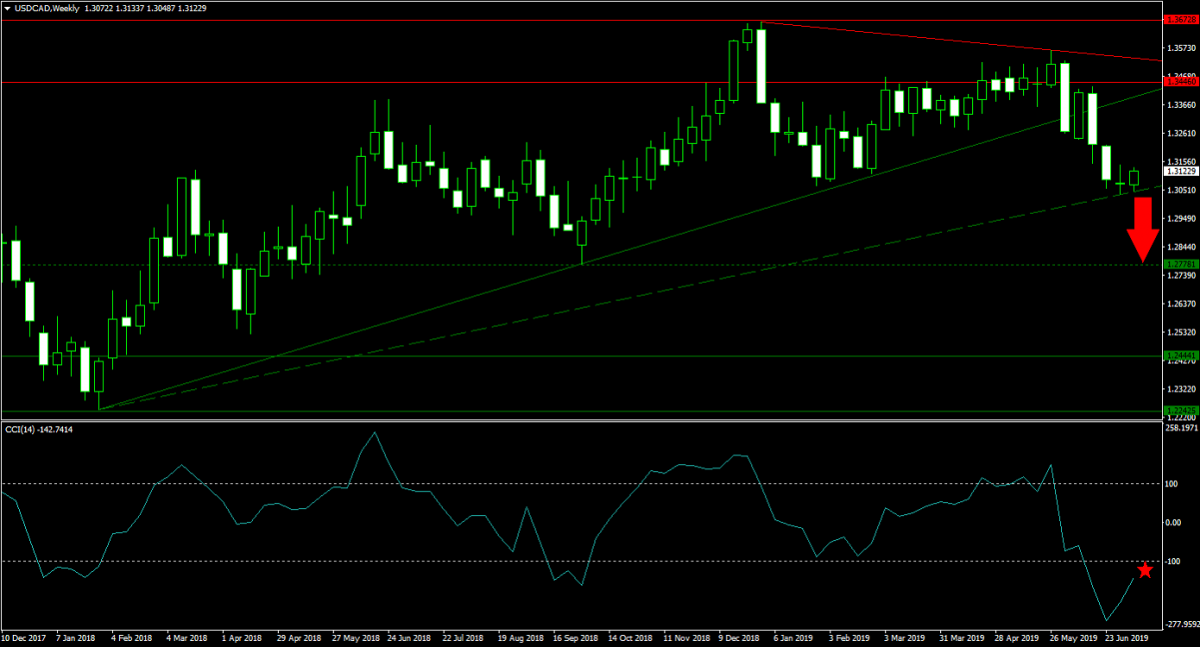

Forex Profit Set-Up #1; Sell USDCAD - W1 Time-Frame

As the Canadian economy is outperforming the US, inflationary pressures evident and a central bank which may refrain from interest rate cuts, the USDCAD is on track to extend its sell-off. After being rejected twice by its horizontal resistance area, bearish pressures mounted. While price action paused the descend at its secondary ascending support level, a renewed push to the downside is favored. A breakdown below support will extend the sell-off until the USDCAD can challenge its next horizontal support level. Forex traders are recommended to sell any rallies into the lower band of its horizontal resistance area.

The CCI is recovering from levels deep inside extreme oversold conditions, after recording a new multi-month low, but is unlikely to cross above -100 before a reversal. Download the PaxForex MT4 Platform and find out why a growing number of profitable forex trader prefer to grow their balance at PaxForex!

Forex Profit Set-Up #2; Buy AUDCAD - W1 Time-Frame

The AUDCAD offers a great hedge to the bullish Canadian Dollar theme as price action dropped into strong support levels from where a short-term reversal is expected. This currency pair descended into its horizontal support level from where bearish momentum is being depleted. A short-covering rally from its primary ascending support level is likely to pus price action above support. The AUDCAD is anticipated to then complete a double breakout, above its primary as well as secondary descending resistance level, until it can advance into its next horizontal resistance level. Spreading buy orders inside the horizontal support are remains the favored trading approach.

The CCI advanced from a new low deep inside extreme oversold territory and bullish momentum is expected to take this technical indicator above -100 from where a short-covering rally is possible. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide to to over 500 pips in monthly profits!

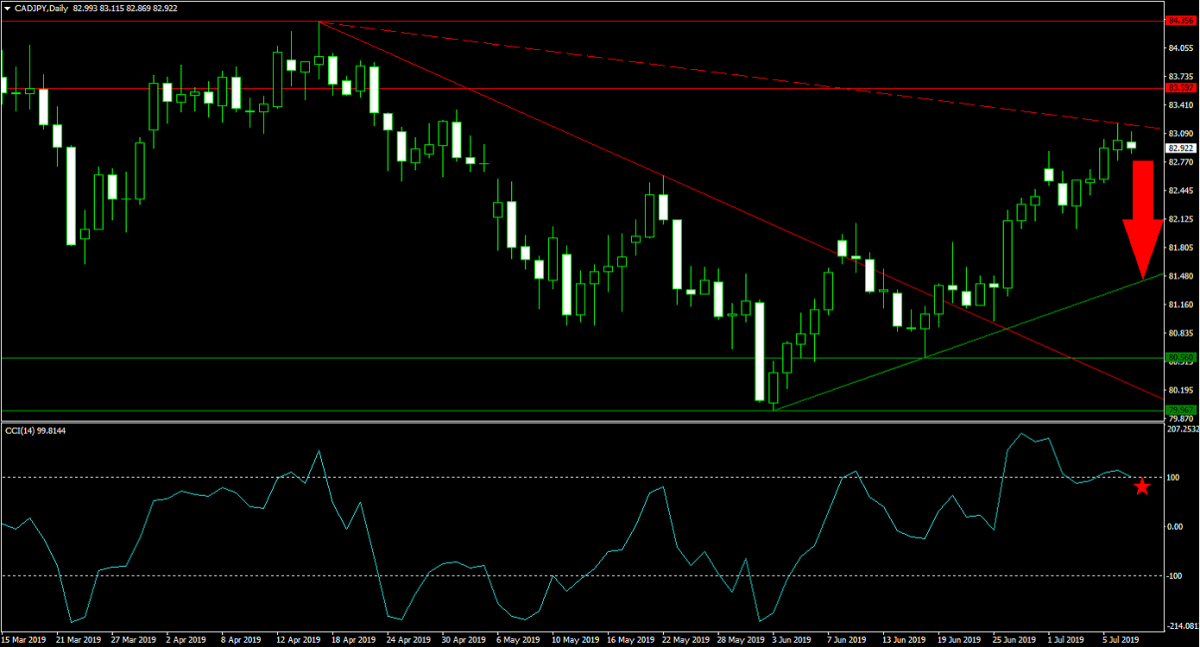

Forex Profit Set-Up #3; Sell CADJPY - D1 Time-Frame

The Japanese Yen is approaching the end of its sell-off as the trend is exhausted. The CADJPY ran into its secondary descending resistance level which is located juts below its horizontal resistance area. Safe-haven demand is favored to increase demand for the safe-haven Japanese Yen . A profit taking sell-off is anticipated to follow which can take price action back down into its primary ascending support level. Forex traders are advised to sell any rallies in the CADJPY into the lower band of its horizontal resistance area.

The CCI retreated from its high inside of extreme overbought conditions and is starting to slip below the 100 level. A sustained move lower from current levels is likely to take this momentum indicator lower and ignite profit taking. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own trading account.

To receive new articles instantly Subscribe to updates.