Is 2018 the year many cryptocurrency riches will be burnt by regulators trying to reign in the hype? Time will tell, but so far 2018 delivered a long predicted correction in the price of cryptocurrencies across the board. Bitcoin is leading the headlines and dropped to its lowest level since December 5th 2017. Technicians are watching the $13,040 mark as a sustained close below this level would suggest that more downside should be expected. On the other side of the equation, Bitcoin did not behave like other assets in the past while others argue that it fits perfectly with any other bubble like asset.

It appears as if in the earlier stages of the Bitcoin advance, the pressure was solely to the upside. There was also a strong correlation between social media, especially Twitter handles, and the advance of Bitcoin. So the more hype there was in social media, the stronger the rally was. This was a phenomenon which has not been witnessed and most of the craze was isolated with the retail crowd as professional investors stayed largely on the sidelines. All the ingredients for a bubble were ready to be mixed together. As Bitcoin matures, more down-to-earth technical aspects to the trade are taking hold.

Just as the cryptocurrency entered the mainstream last month with the CBOT and the CME offering futures in Bitcoin, reality appeared to set in. Many who flocked to Bitcoin did not like main stream to get involved which is one reason Bitcoin came crashing down from just shy of $20,000 to a brief dip below $11,000. As speculators viewed the sell-off in December as a buying opportunity, it now seems to have been what is known as a ‘dead cat bounce’ as the sell-off is under way once again. As Bitcoin remains extremely volatile, some key technical levels should now be carefully observed for potential clues of where the price is headed next.

Open you PaxForex Trading Account today and make a deposit using Bitcoins. It has never been easier to diversify your digital wealth into real assets which you can further grow in the forex market. Sophisticated traders understand the need to spread around risk and so should you. Use a portion of your Bitcoin, trade forex and enjoy your digital capital in real life.

Bitcoin has also dragged down most of its peers as money is flowing out of cryptocurrencies. Governments around the globe are shutting down exchanges which send ripple effects through the cryptocurrency market. The Chairman of the European Securities and Markets Authority, Steven Maijoor, had a dire warning as he stated that ‘Investors should be prepared to lose all their money.It has an extremely volatile value, which undermines its use as a currency. And it’s also not broadly accepted.’ Make sure that you are not part of the crowd which will end up with losses and take advantage of our 3 better trades for your wallet as Bitcoin resumes sell-off.

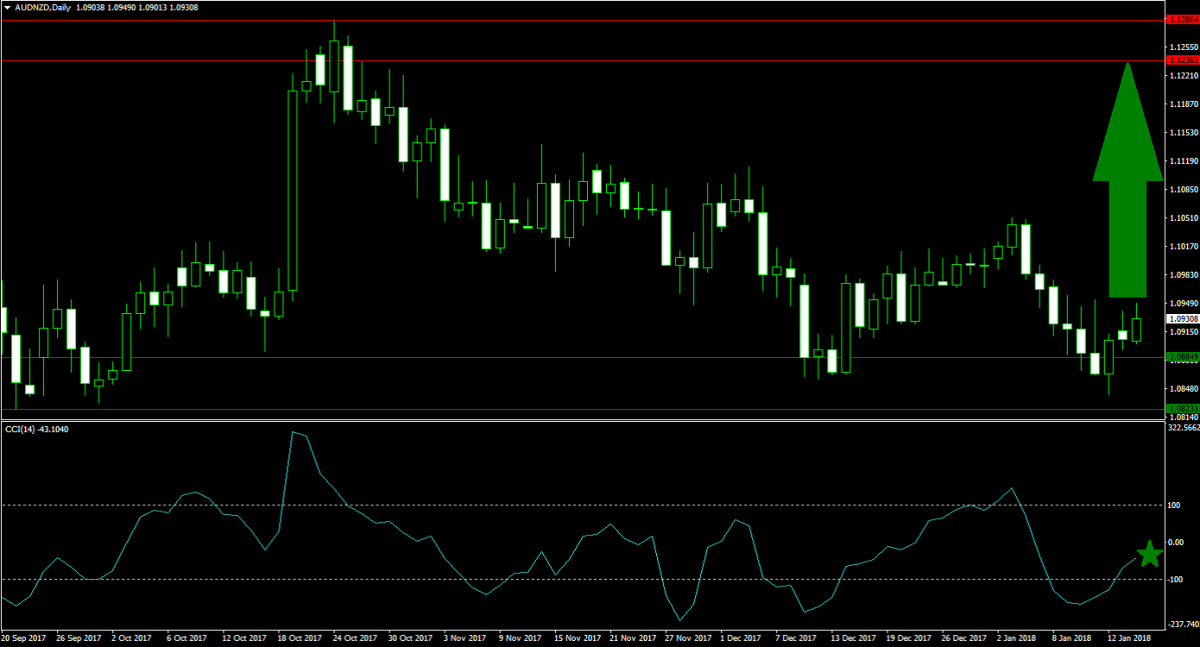

Forex Profit Set-Up #1; Buy AUDNZD - D1 Time-Frame

Since the majority of cryptocurrency traders enjoy buying, and not selling, exotic assets we will start off with the AUDNZD. Price action just pushed above its horizontal support area which represented a major bullish move. This currency pair is now clear to advance back into its horizontal resistance area. This trade offers very little downside risk with solid upside potential and forex traders are advised to stagger their buy orders between 1.0885, the upper band of its horizontal support area, and 1.0950 which represents a minor resistance level.

The CCI, a momentum indicator, confirmed an increase in bullish pressures with a breakout above the -100 level, which indicates extreme oversold conditions. A further push above the 0 level is likely to invite more buy orders in the AUDNZD. The PaxForex Fundamental Analysis Section provides traders the most profitable trade set-ups each day together with key fundamental data. Subscribe and learn how to earn 500+ pips every month.

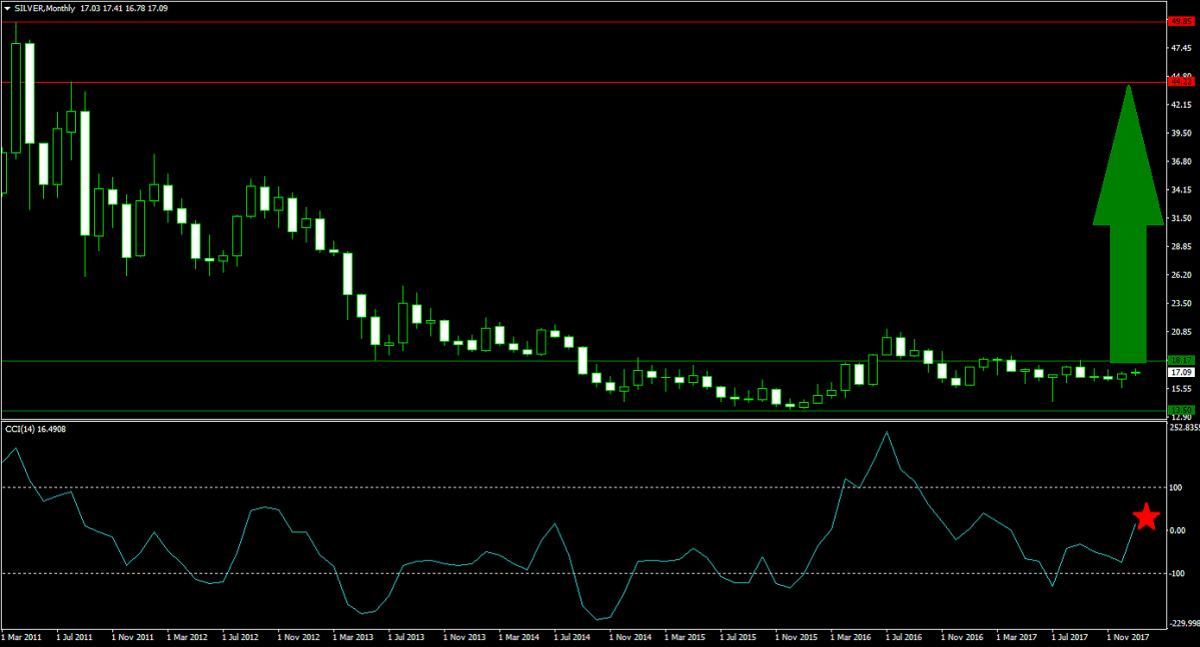

Forex Profit Set-Up #2; Buy Silver - MN Time-Frame

Bitcoin is all about mining, but it is always wise to direct some money into real commodities which are mined. Silver offers an excellent long-term trade for patient investors. This commodity is currently trending sideways inside of a strong horizontal support area while bullish pressures are accumulating. This coincides well with the contraction in the price of Bitcoin as capital outflows are looking for a safe haven trade. A breakout above its support area would enable Silver to advance to levels not seen since 2012. Entry levels between 17.000 and 18.000 are recommended in order to reduce risk and increase earnings.

The CCI already completed a breakout above the -100 level and above the 0 level which places bullish momentum in the driver seat. Silver has now plenty of unrealized upside potential and set to attract more buy orders. PaxForex Recommendations are distributed to all traders every day in order to highlight profitable trading opportunities which will help you grow your forex trading account.

Forex Profit Set-Up #3; Buy EURPLN - D1 Time-Frame

The EURPLN has moved to the downside despite the political clash between Warsaw and Brussels, but price action has halted its contraction after forming and confirming a new horizontal support area. This currency pair now successfully broke out above this area which suggests that a counter-trend advance is likely to materialize. Forex traders are advised to place their buy orders above and below the 4.1610 which marks the upper end of its current horizontal support area.

The CCI already completed a breakout above the -100 level and upside momentum was strong enough to carry this indicator above the 0 mark as well. Forex traders should account for more upside as price action recovers. Download your MT4 Trading Platform now and add this trade to your forex portfolio before the short-covering rally will commence.

To receive new articles instantly Subscribe to updates.