Welcome back everyone to another exciting update in the fascinating world of forex and cryptocurrency trading! Bitcoin eclipsed the $9,000 level and you may hear and read more about FOMO driving price action higher. Who or what is FOMO? It’s an acronym which stands for “Fear of missing out”, basically everyone was scared of Bitcoin below $4,000, then watched it more than double and are now scared that if the remain on the sidelines for a bit longer we will soon have new all-time highs above $20,000. FOMO is dangerous and while I am bullish on Bitcoin, I want to take this chance to caution against falling for all the hype on social media. As I pointed out in last week’s update “Bitcoin - Forex Combo Strategy: Monero’s Fight Against ASICs”, don’t rule out a second bearish wave.

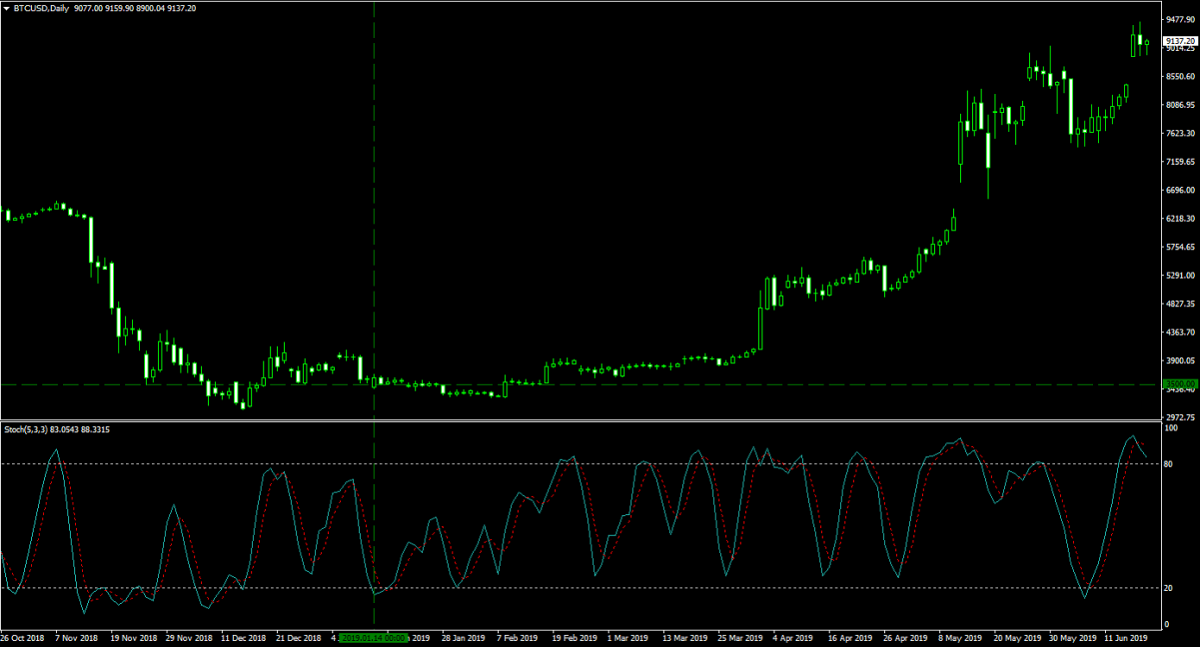

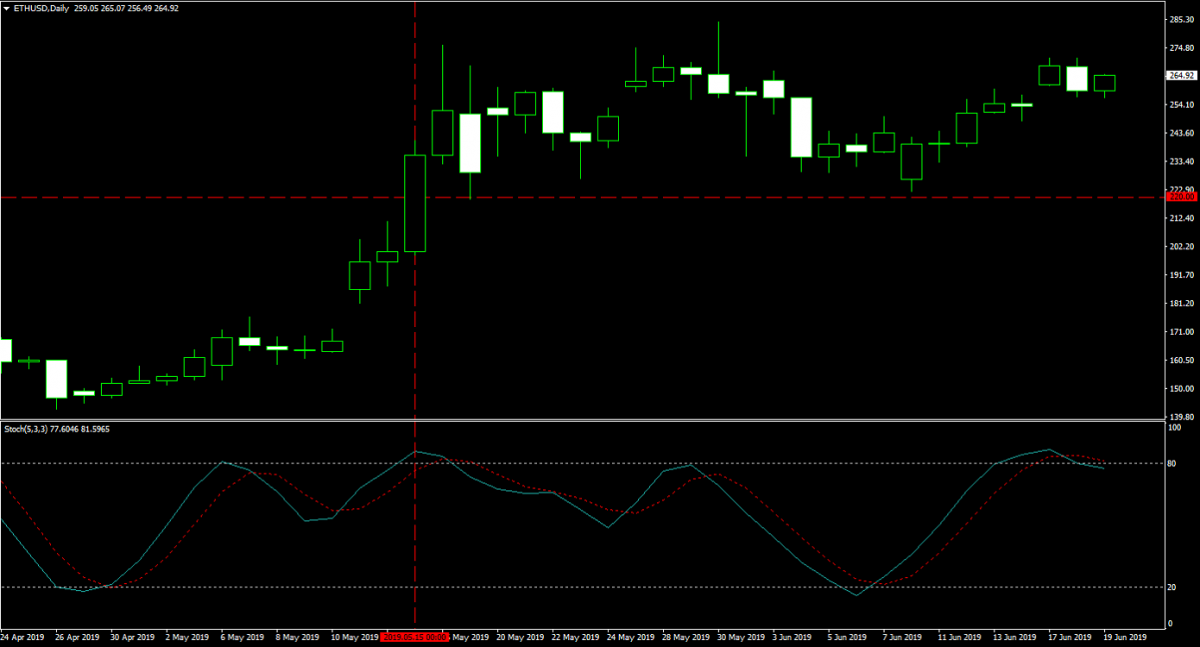

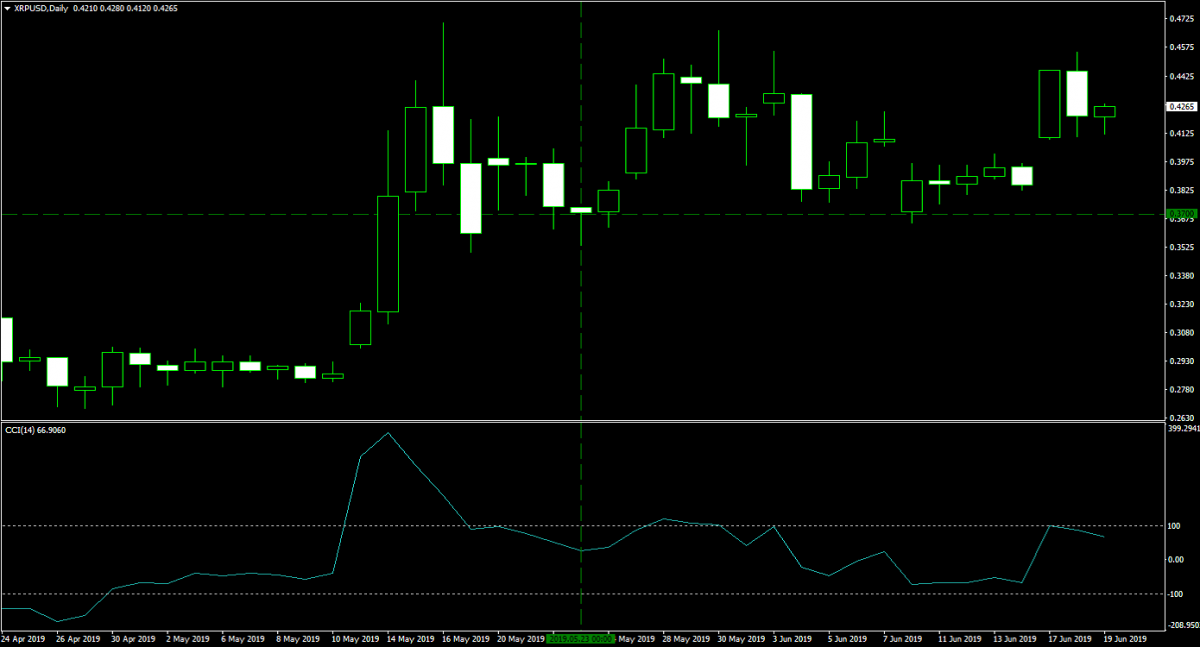

There is a big difference in market dynamics now that Bitcoin is back above $9,000 and last time it was at this level. The first time was driven by retail trading headline chasers and FOMO, now there is a lot of smart money in the sector which understands that in order to make money, you need to close out a position and re-enter after a buying opportunity presents itself. As of now I am happy to hodl my 100 Bitcoins which I bought on January 14th 2019 at $3,500 and I am not adding to this position unless we drop back below $7,000. Ethereum has been under a rise of bearish pressures as it is stuck in a trading range and I believe it will accelerate to the downside which is why I sold 10,000 Ether on May 15th 2019 at $220. Then there is Ripple which is really advancing its business and the latests sign comes through its investment and partnership with MoneyGram. The reaction has been rather muted, but I am confident that my 5,000,000 Ripple long position which I took on May 23rd 2019 at $0.3700 will benefit long-term. The three charts below show the current make-up of my cryptocurrency portfolio.

On March 13th 2019 I wrote about Ripple and why I am bullish on it, feel free to take a look at the post “Bitcoin - Forex Combo Strategy: Ripple Opening New Frontiers”. On Monday, June 17th 2019, Ripple announced that it will invest $30 million into MoneyGram through the purchase of stock priced at $4.10. This was announced after the markets closed and shares of MoneyGram finished at $1.45. This represents a premium of 182.75% and shares soared in after-hour trading. Ripple also has the option to purchase another $20 million of MoneyGram shares priced at $4.10 over the next two years which is the initial length of their partnership with an option to extend it.

The Ripple-MoneyGram partnership is centered on Ripple’s xRapid platform and MoneyGram signed up as a pilot partner on January 2018. Alex Holmes, CEO of MoneyGram, stated “Through Ripple’s xRapid product, we will have the ability to instantly settle funds from US Dollars to destination currencies on a 24/7 basis, which has the potential to revolutionize our operations and dramatically streamline our global liquidity management.” The CEO of Ripple, Brad Garlinghouse, added “This is a huge milestone in helping to transform cross-border payments. MoneyGram is one of the largest money transfer companies in the world and the partnership will continue to further the reach of Ripple's network. I look forward to a long-term, very strategic partnership between our companies.”

Ripple didn’t just pick MoneyGram by chance, it was a smart move. Many will be shocked about the price Ripple paid, but MoneyGram saw its share price tumble by over 70% since last November after missing on revenues. While the price Ripple paid for is still higher than were MoneyGram was trading before its collapse, the true value of this deal is reaching far above share prices. MoneyGram is active in over 200 countries and has processed over $600 billion worth of transactions. The company has relied on the forex market and transaction times took between 15 minutes to one hour with a fee of $30. This will now change to a few seconds and fractions of a penny which will likely allow the firm to gain market share in the global remittance market and boost revenues. The share price will follow suit and Ripple could earn a substantial amount of cash plus the positive boost to Ripple as it moves one step closer to be a solid competitor to fiat currency transactions.

The cash infusion and partnership was much needed and appreciated by MoneyGram which also announced that it is working on closing the refinancing of its revolving credit facility as well as first lien loan. The CFO of MoneyGram, Larry Angelilli, pointed out that “We are very pleased with the terms of the Ripple investment which supports the Company with permanent capital and additional liquidity. This partnership also provides MoneyGram with the opportunity to improve operating efficiencies and increase earnings and free cash flow.” I think this is yet another great step in the right direction, not only for Ripple but for cryptocurrencies in general. I continue to be very bullish on Ripple and should price action drop below $0.4000 I will add to my stake.

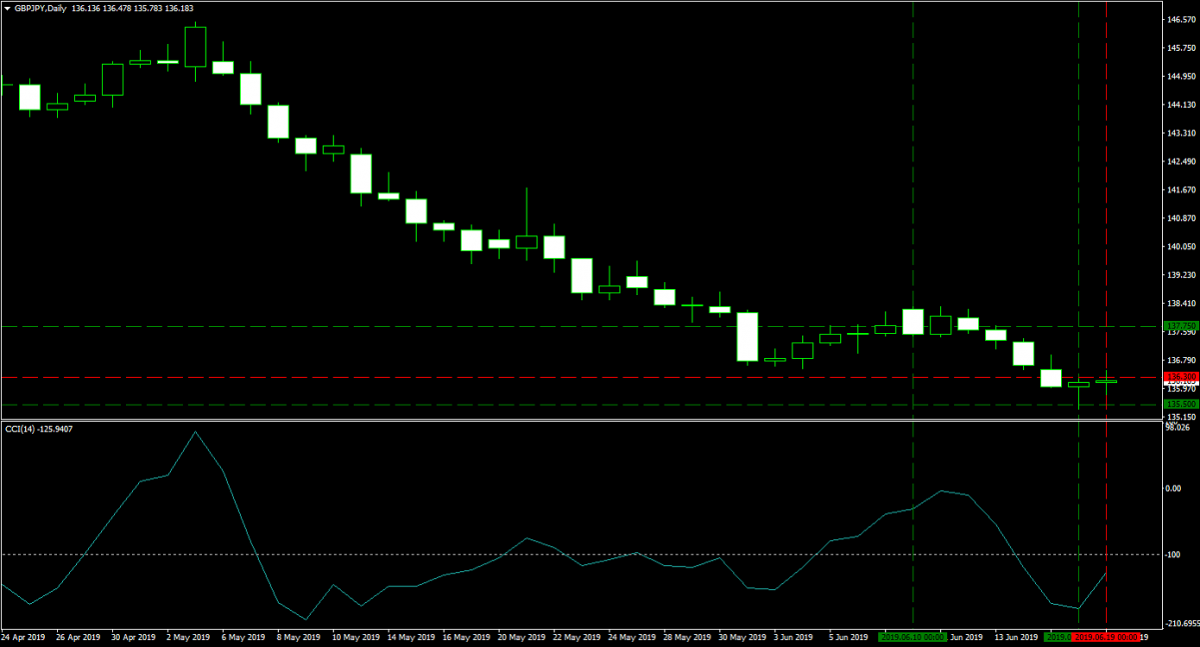

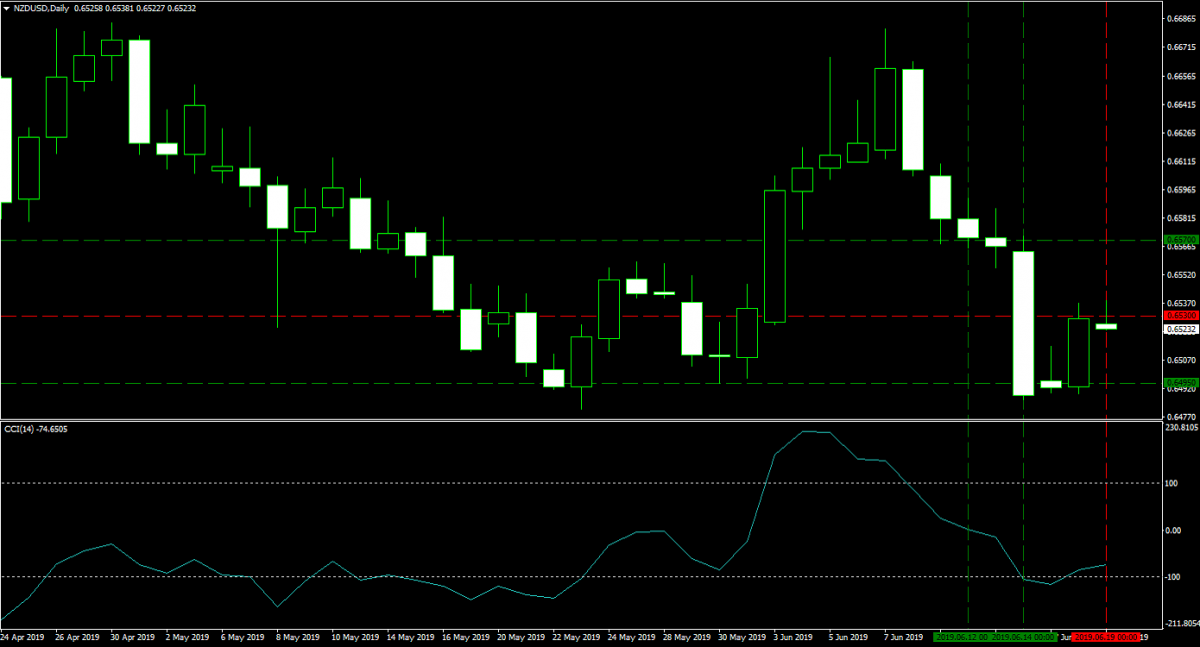

This bring me to the forex investment part of my Bitcoin - Forex Combo Strategy. I have to admit that I am overexposed to the British Pound and the forex market has disagreed with my bullish stance on the currency. My cash balance is sufficient enough to wait out the storm and wait for the dust to settle which is why holding a big amount of cash in regards to the lot sizes you trade is key to success. I took two quick trades in order to reduce my British Pound exposure as well as US Dollar exposure before today’s FOMC statement which I expect to be dovish and therefore bearish for the US currency. Let’s start with my GBPJPY long position, yesterday on June 18th 2019 I added 500 lots at 135.500 and earlier this morning I closed my 750 lots GBPJPY long position at 136.300 for a profit of $34,754. I used the same approach to get out of my NZDUSD long position and bought 500 lots on June 14th 2019 at 0.6495. Earlier today, June 19th 2019, I closed my 750 lots at 0.6530 for a profit of $75,000. The two images below show my salvage trades and ultimate profitable exit of both trades.

As ECB President Draghi all but assured markets that more QE is on its way, I took a risk trade and added a third short position to my EURGBP trade in order to get out of my second position and now am looking to add to my first position at a better price. Yesterday I sold 800 lots in the EURGBP at 0.8970 and this morning I closed this position as well as my 400 lots short position which I took at on May 22nd 2019 at 0.8830 at 0.8920 for a profit of $46,328. I continue to hold on to my 200 lots EURGBP short position taken on May 14th 2019 at 0.8680 for a margin requirement of $44,730 with a pip value of $2,568.48and plan to add to it above 0.8980. I think the Euro is in for a correction and believe that the British Pound will perform a lot better than many analysts currently predict. The chat below shows the adjustments to my EURGBP trade.

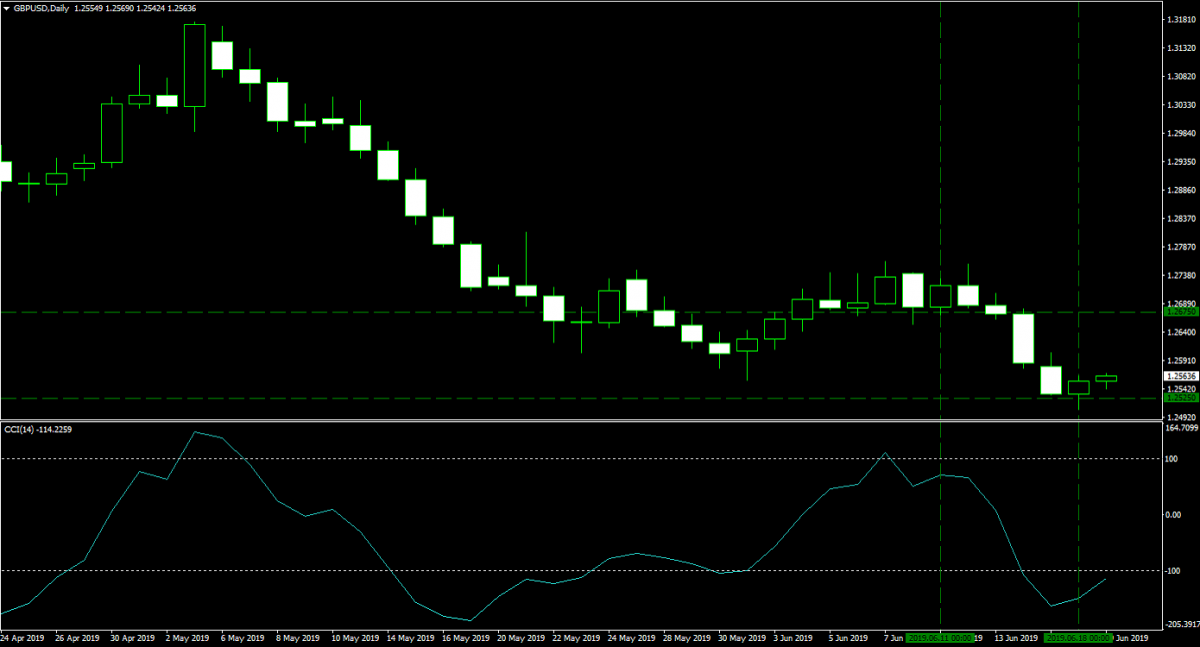

A dovish FOMC statement today is likely to send the US Dollar into a sell-off which is why I bought another 500 lots in the GBPUSD yesterday, June 18th 2019, at 1.2525. The margin requirement was $125,468 with a pip value of $5,000. This was an addition to my exiting 250 lots long position which I bought on June 11th 2019 at 1.2675 for a margin requirement of $63,744 with a pip value of $2,500.00. While I wanted to reduce my exposure to the British Pound, given today’s FOMC announcement this addition made sense and I have still less exposure than before. I did not add any new currency pairs to my forex portfolio as I was in house cleaning mode and I wanted to await FOMC announcement before committing more capital to my forex trading strategies. The chart below shows my GBPUSD positions.

Here is the summary of my Bitcoin - Forex Combo portfolio: I hodl 100 Bitcoins worth $912,660, a 10,000 Ethereum short position worth $1,660,700, a 5,000,000 long position in Ripple worth $2,129,000 and a total cash portfolio worth $9,592,176. In addition I have the following forex positions in my portfolio: a 200 lots EURGBP short position worth -$558,863 and a 750 lots GBPUSD long position worth 114,212. My total Bitcoin - Forex Combo portfolio is worth $13,849,885, up $258,021 from last week’s value of $13,591,864 and at a new all-time high. As this week’s update shows, patience and capital remain key to a successful portfolio. I am glad I had the chances to clean up and streamline my forex positions which has reduced my risk and pushed my cash balance closer to $10M. Some may wonder why I never withdrew any cash for living expenses and I will dive into this next month as I will make my first cash withdrawal. I extend my invitation to join me at PaxForex by opening your own MT4 Trading Account and follow my Bitcoin - Forex Combo Strategy! Just comment below with any questions you may have and I will be happy to help you get started !

To receive new articles instantly Subscribe to updates.