Great to see everyone back and welcome to the new followers of my Bitcoin - Forex Combo Strategy which I execute right here at PaxForex! Let’s dive right into, shall we? Let me follow up on last week’s post “Bitcoin - Forex Combo Strategy: Ripple Opening New Frontiers” really quick, as Google just launched its cloud-based gaming platform Stadia which doesn’t require a gaming console or long downloads anymore as everything is hosted in the cloud and players can start playing on one device, for example their PC at home, and then pick-up the game on their smartphone later on. While Google may struggle to get studios to create games for Stadia and with Microsoft’s competitor, xCloud, slated for release later this year and with a better outlook thanks to its relationship with studios, it shows that Ripple has been on the right track with their push into the gaming sector which is likely to invite other cryptocurrencies into this sector.

I think it is safe to state that when it comes to regulation, the cryptocurrency world is split at best. Cryptocurrencies were created to offer a decentralized alternative for the global economy, away from counter-productive regulation which cripples the financial system and fiat currencies. As the bubble formed and deflated calls for regulation have increased. This is especially true as more institutional traders entered and displaced retail traders. Some analysts believe that regulation will create demand and boost overall price action, but regulation may also kill the backbone of cryptocurrencies: decentralization and privacy. Once the sector becomes fully regulated as many countries propose, it risks to become yet another controlled asset like fiat currencies.

Regulators are known to make wrong decisions, offer bad proposals and enforce regulation which is not only counter-productive, but also destructive of the asset. It is no surprise that the Canadian Securities Administrators (CSA) and the Investment Industry Regulatory Organization of Canada (IIROC) have proposed to ban short-selling and margin trading of cryptocurrencies. The intend of their joint publication was to gather community feedback and one can only hope that it will be voted down. Short-selling and margin trading are great trading tools every profitable trader uses and the issue is not the tools, but how they are used by individual traders.

At the beginning of their proposed framework, the regulators stated “Although DLT may provide benefits, global incidents point to crypto assets having heightened risks related to loss and theft as compared to other assets. To reduce the risks of potentially manipulative or deceptive activities, in the near term, we propose that Platforms not permit dark trading or short selling activities, or extend margin to their participants.” The best example I can think of is the temporary ban on short-selling of financial stocks during the 2008 financial crisis. Regulators thought they would calm markets, but the selling only intensified. This proposed framework is very dangerous as it will only destroy a young market and strip it off natural trading tools necessary to mature into a healthy market with global reach and implications.

The Japanese regulator limited margin trading and allowed short-selling. Canada’s ill-advised reaction is a result of the collapse of QuadrigaCX and the death of its CEO who was the sole custodian of private keys to $250 million worth of customer's cryptocurrency assets. This is how regulators damage free markets, not understanding the cause, employing individuals which no knowledge of the substance and creating regulation which is damaging. They rounded up their proposal by adding that “We contemplate that Platforms seeking registration as an investment dealer registration and IIROC membership that plan to provide custody of crypto assets will not only need to satisfy existing custody requirements but will also be expected to meet other yet-to-be-determined standards specific to the custody of crypto assets.”

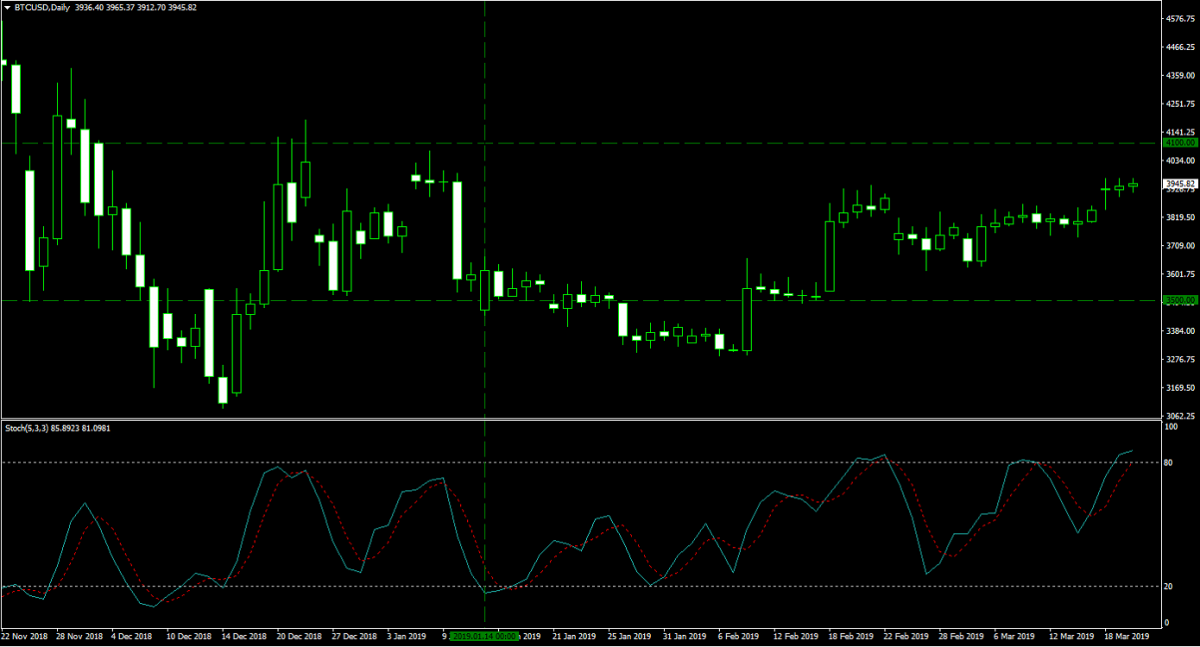

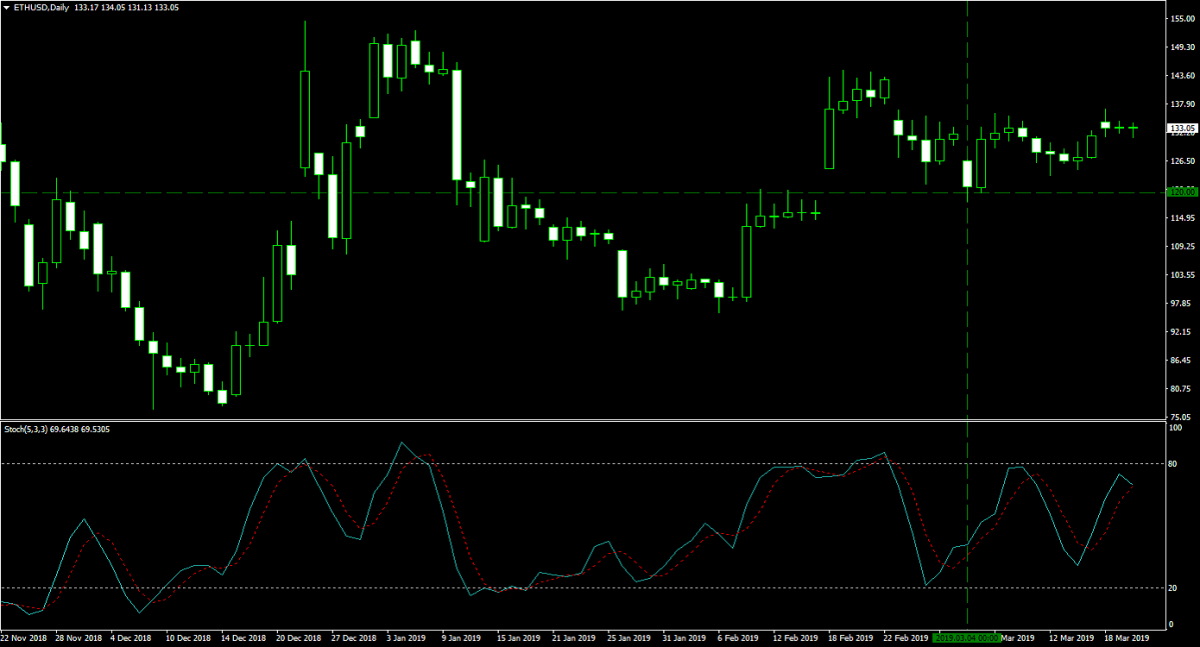

Let’s hope that enough smart responses will kill the proposed framework as Canada was moving in the direction of a cryptocurrency friendly nation, this would reverse their progress. Overall price action has been positive since my last update with the exception of Ripple which remained stuck around the $0.3000 level. Bitcoin is once again flirting with the $4,000 as I expected last week and I believe we may have enough momentum for a sustained breakout above which is good news for my 200 Bitcoins I am hodling at an average entry price of $4,315. My 3,000,000 Ripple with an average entry price of $0.3075 are being held hostage by a standoff between bulls and bears at the $0.3000 level, but with great fundamentals moving forward I expect bulls to prevail. My 7,500 Ethers with an entry price of $120.00 received a nice boost, but failed to hold on to levels above $140.00. The three images below show my cryptocurrency positions.

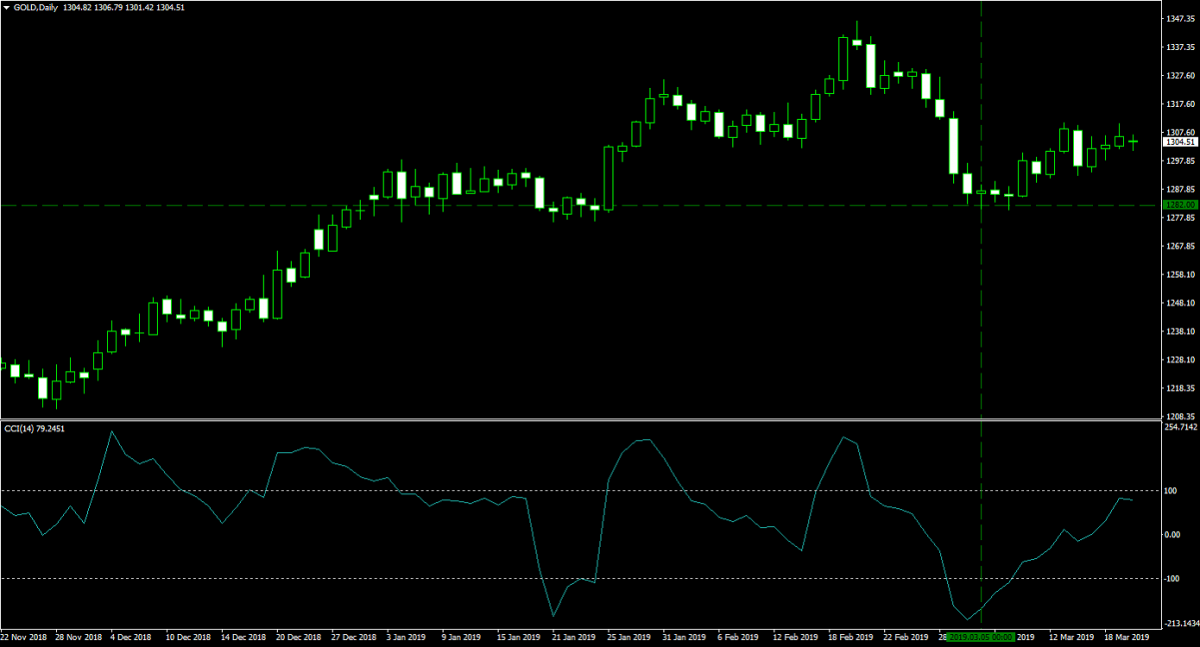

Gold remained above the $1,300 level with bullish momentum on the rise. I am now eyeing the $1,346.49 level as the next are of resistance which represent the most recent intra-day high before its pull-back. I currently hold 40 lots of Gold which I purchased at $1,282.00 for a margin requirement of $51,408 and with a pip value of $40.00. You can see my current Gold position in the image below.

Last week I only had two open forex positions in my portfolio, both which were closed for a profit. My 75 lots short position in the USDCAD was closed through my adjusted stop loss at 1.3300 for a profit of 125 pips or $69,815 on March 14th 2019. On the same day, my 100 lots EURUSD long position was closed at 1.1330 for a profit of 150 pips or $150,000, again through the trigger of my stop loss order. The two images below show my completed forex trades.

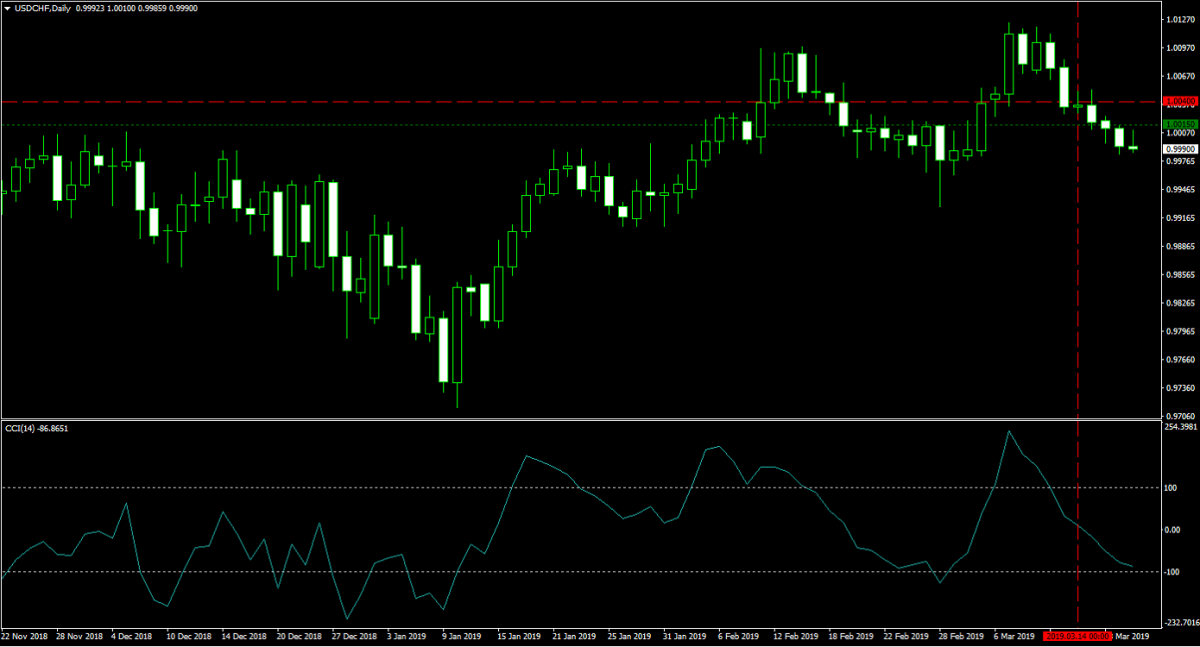

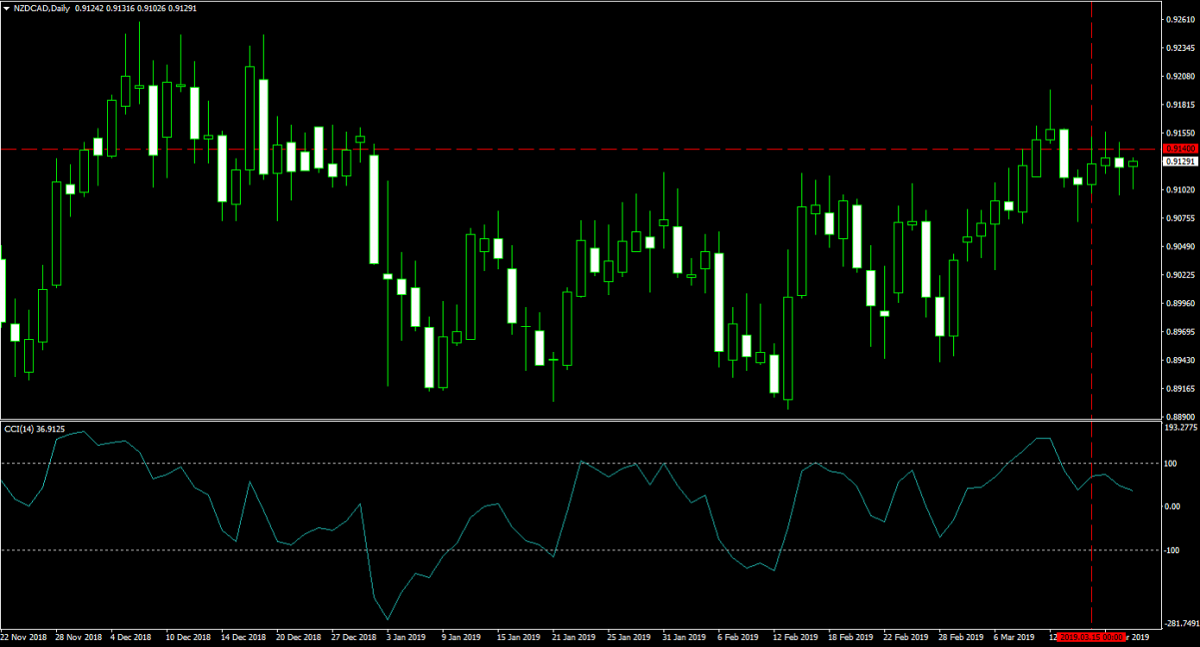

On March 14th 2019 I sold 100 lots in the USDCHF at 1.0040 for a margin requirement of $20,000 with a pip value of $1000.99. You can read the trading recommendation at “USDCHF Fundamental Analysis – March 14th 2019” and I adjusted my stop loss to 1.0015 for a guaranteed profit of 25 pips or $25,025. On March 15th 2019 I added a 100 lots short position in the NZDCAD according to this trading recommendation “NZDCAD Fundamental Analysis – March 15th 2019”. My entry level was 0.9140 for a margin requirement of $13,686 with a pip value of $749.77. The two images below show the forex trades which I added last week.

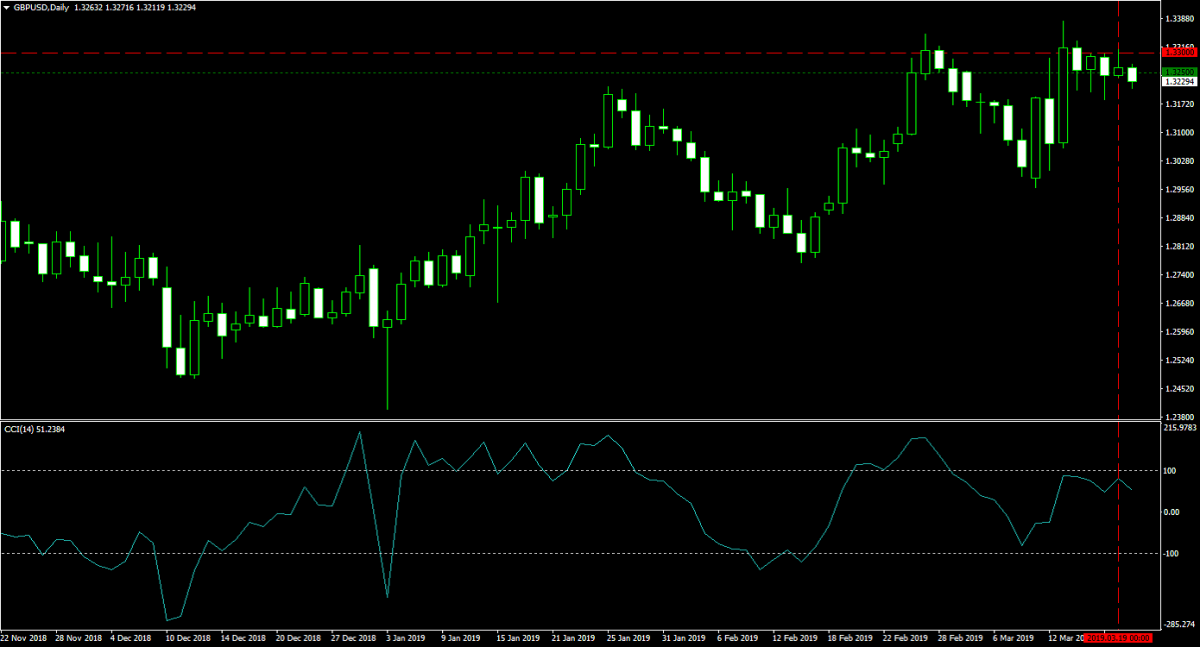

This week I added a 100 lots short position on March 19th 2019 in the GBPUSD at 1.3300 for a margin requirement of $26,455 with a pip value of $1,000. You can read the trading recommendation I acted upon at “GBPUSD Fundamental Analysis – March 19th 2019”. I moved my stop loss to 1.3250 for a guaranteed profit of 50 pips or $50,000. I added to my British Pound bearish trades today, March 20th 2019, with a long position in the EURGBP. I bought 100 lots at 0.8560 for a margin requirement of $22,703 with a pip value of $1,322.73. The original trading recommendation can be found at “EURGBP Fundamental Analysis – March 20th 2019” and the two images below show my forex trades from this week.

Let’s wrap it up with my overall portfolio update: I hodl 200 Bitcoins worth $789,170, 3,000,000 Ripple worth $909,900 and 7,500 Ethers worth $999,825. I also have 40 lots of Gold worth $138,848 and a total cash balance of $2,015,301. My forex portfolio consist of four open 100 lots positions, two protected for a guaranteed profit: I have a short position in the USDCHF worth $70,050, a short position in the NZDCAD worth $16,685, a short position in the GBPUSD worth $116,455 and a long position in the EURGBP worth $80,903. My total portfolio is worth $5,137,137, up 333,070 as compared to last week and to a new all-time high. This also marks the first time my portfolio eclipsed the $5M level. I am very excited to see where my Bitcoin - Forex Combo Strategy will take us and I invite you to open your PaxForex Trading Account today in order to join me on my journey and to start your own!

To receive new articles instantly Subscribe to updates.