Bitcoin’s meteoric rise has accelerated in October as the biggest crypto currency rallied past the $5,000 as well as the $6,000 in one month alone and is currently trading above $7,000. Many are wondering how much further Bitcoin can rally before it will enter a correction or a potential crash, if ever. Currently it appears as if $8,000 is a level it could reach and breach and two Goldman Sachs analysts circulated a research note this past Sunday signalling a cautionary note as Bitcoin continues its surge.

Many have issued those warnings in the past only to be proven wrong, but as bearish sentiment is on the rise it leaves the door open for a move in the opposite direction. History teaches us that bubbles, if Bitcoin is a bubble, tend to burst and that the prices drop by roughly 80%. Assuming that $8,000 would be the last big number it will tackle before crashing this would put Bitcoin back down to the $1,600 level. While many believe there would be a corrective move, an 80% correction is not expected by the majority of market watchers, traders and analysts.

One reason Bitcoin trader’s and miners could see more volatility is the start of futures trading on Bitcoin which was announced by the world largest exchange, the Chicago Mercantile Exchange or CME. This would allow traders to go long and short which would create a more realistic market as well as price for the crypto currency. Despite calls for caution, if the Elliot Wave Theory is applied to price action of Bitcoin, it suggests that we could witness a slowdown in the rise during the 4th wave which would see the 5th and final wave take Bitcoin near the $10,000 mark from where a bubble burst scenario would become more feasible.

What will happen to traders who are invested in Bitcoin should a crash materialize? Will some of the money come back into the forex market? How to trade a potential crash? Whenever a bubble bursts, it is accompanied by panic which feeds the crash, but there are always opportunities to protect your portfolio and profit from a sharp move to the downside. It is best to hedge your account with non-Bitcoin and non-crypto currency positions. Here are three ways a smart hedge can protect you from the potential fallout of a price action correction in Bitcoin.

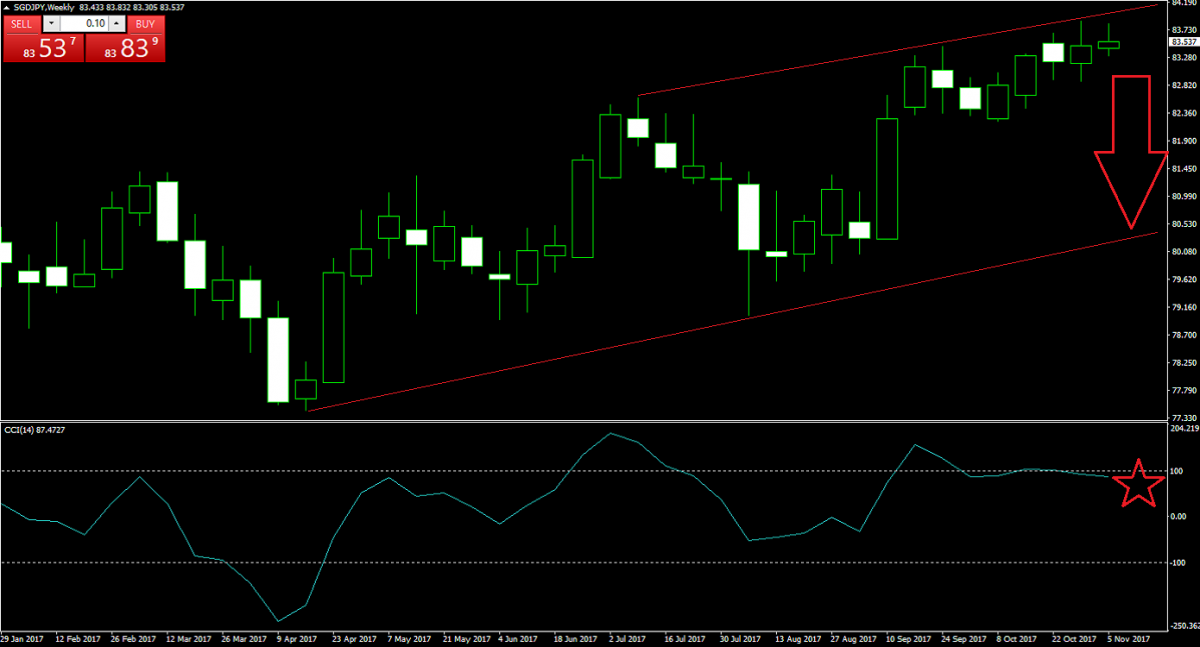

Forex Profit Set-Up #1; Buy SGDJPY - W1 Time-Frame

We start our series with an exotic currency pair, the SGDJPY, which should benefit as the Japanese Yen remains the prime global currency pair during turbulent times. We are taking a look at the W1 chart which shows a bullish price channel while price action is currently drifting higher near the ascending resistance level of this chart pattern. The CCI already completed a breakdown below the 100 level which indicates a weakening in the up-trend.

Forex traders can expect a move down to around the 80.500 mark which would take the SGDJPY down to the ascending support level of its long-term bullish chart pattern. Open your PaxForex trading account now and enter this trade as part of your longer term portfolio hedge.

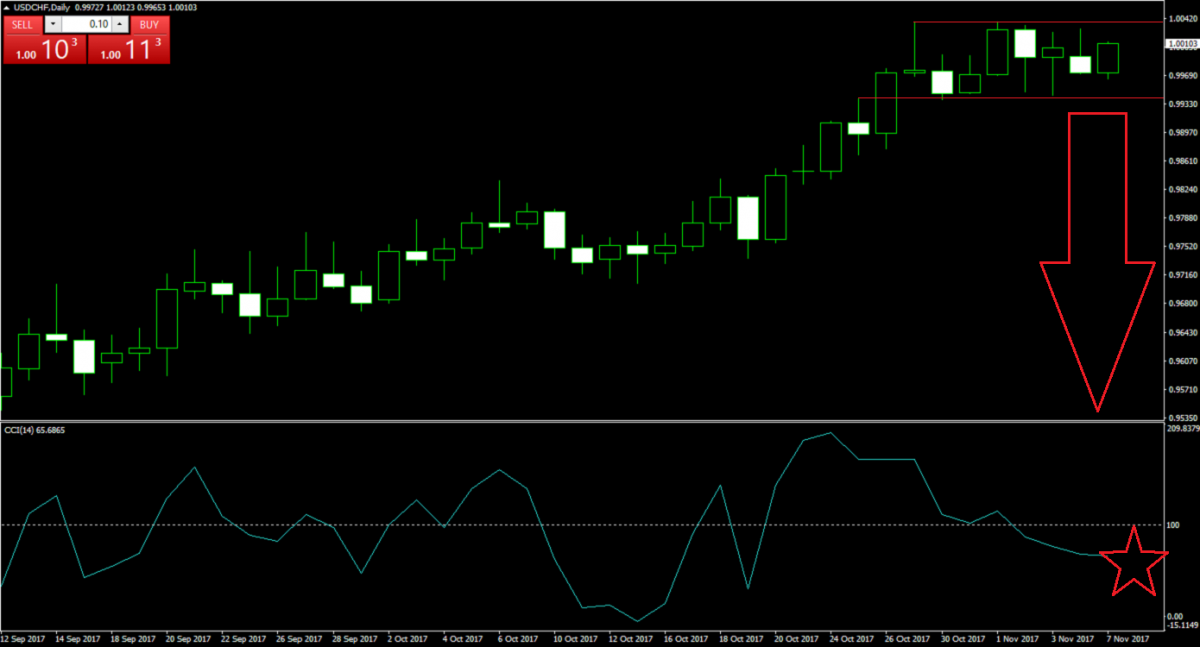

Forex Profit Set-Up #2; Buy USDCHF - D1 Time-Frame

The USDCHF has rallied sharply, but price action has lost momentum and this currency pair has entered a sideways trend near a major psychological mark as well as major round number, parity. This currency pair has lost its upside momentum several times as it tried to sustain its breakout above the crucial 1.0000 mark and as the CCI broke down below the 100 level, momentum is currently on the rise for a corrective move which could take this currency pair down to the 0.9600 level before stabilizing.

As Bitcoin’s volatility is expected to increase, forex traders may want to bolster their trading accounts. PaxForex offers very attractive deposit bonuses which provide an excellent way to increase the size of your trading account.

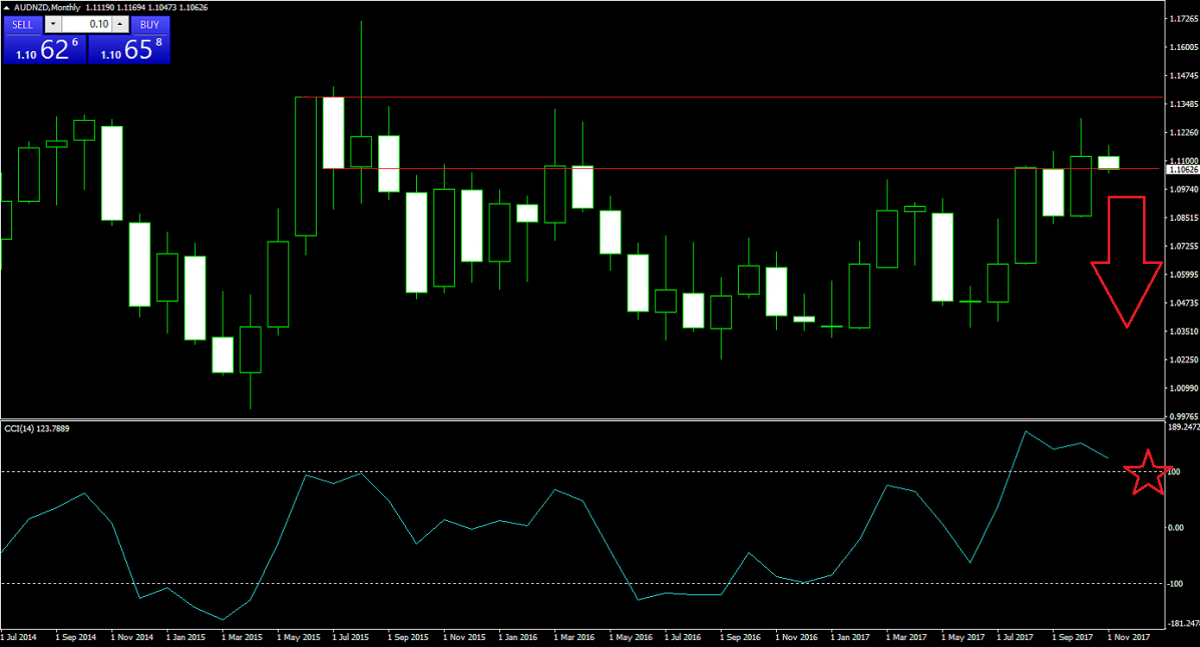

Forex Profit Set-Up #3; Buy AUDNZD - M1 Time-Frame

The Australian Dollar as well as the New Zealand Dollar are both commodity currencies and while Bitcoin mining has nothing to do with commodity mining, this currency pair remains with the mining theme and also offers a very attractive long-term short entry. A double top formation is visible on the M1 chart which is a very bearish trading signal and coupled with the CCI retreating from a record high makes this trade a no-brainer. A breakdown of the CCI below 100 is expected to accelerate a move to the downside.

A professional trading environment is crucial for the long-term health of a forex portfolio and PaxForex offers great trading conditions which allows new as well as seasoned traders to grow their account pip-by-pip with confidence.

To receive new articles instantly Subscribe to updates.