According to most, if not all, central bankers quantitative easing following the 2008 global financial crisis was the tool which prevented deflation from taking place. Quantitative easing programs were in most cases bond purchases by central banks in order to push down yields. Some central banks, like the Bank of Japan, also purchased equity stakes in order to combat deflationary pressures in the hope to kick-start the economy. Now, central banks are looking to increase interest rates and decrease their huge balance sheets which were acquired over the past decade.

The US Federal Reserve led the interest rate cut cycle and the quantitative easing push and is now the first one which is in the process of slowly reversing both. The ECB is scaling back its quantitative easing program and the Bank of England has delivered its first interest rate increase in over a decade. Only the Bank of Japan keeps full steam ahead. Bank of England economist Richard Harrison wrote a blog post on the central banks blog ‘Bank Underground’, making the case for more stimulus buying but also suggesting that central bankers should resist to keep their balance sheets boated as they are.

According to Harrison, ‘Active’ QE improves welfare precisely because it is active, if the central bank merely holds a fixed proportion of long-term debt on its balance sheet, then it will not replicate this feature of an active QE policy. Harrison further added, ‘If real interest rates remain low for a prolonged period, perhaps because of secular factors, then we would expect the lower bound on policy rates to be encountered more often. During these more frequent lower bound episodes, the model predicts that QE should be used to help support spending and inflation.’

PaxForex analysts are providing all forex traders daily fundamental analysis as well as trading recommendations in order to get the best trades out to client. PaxForex understands that as traders earn money and increase their portfolios, so does the company grow. Make sure to get on board and join the growing number of forex traders who earn money through PaxForex.

The European Central Bank is debating what it should do after September 2018 when their quantitative easing is supposed to come to an end. Harrison, who works at the Bank of England’s Monetary Assessment and Strategy Division, does not believe central banks will hold large balance sheets forever but it is unclear on what a good exit strategy would look like. More buying will eventually lead to more selling which will have a global ripple effect. Take a look at our three trades which will get your forex portfolio through any collateral damage of central bank interference.

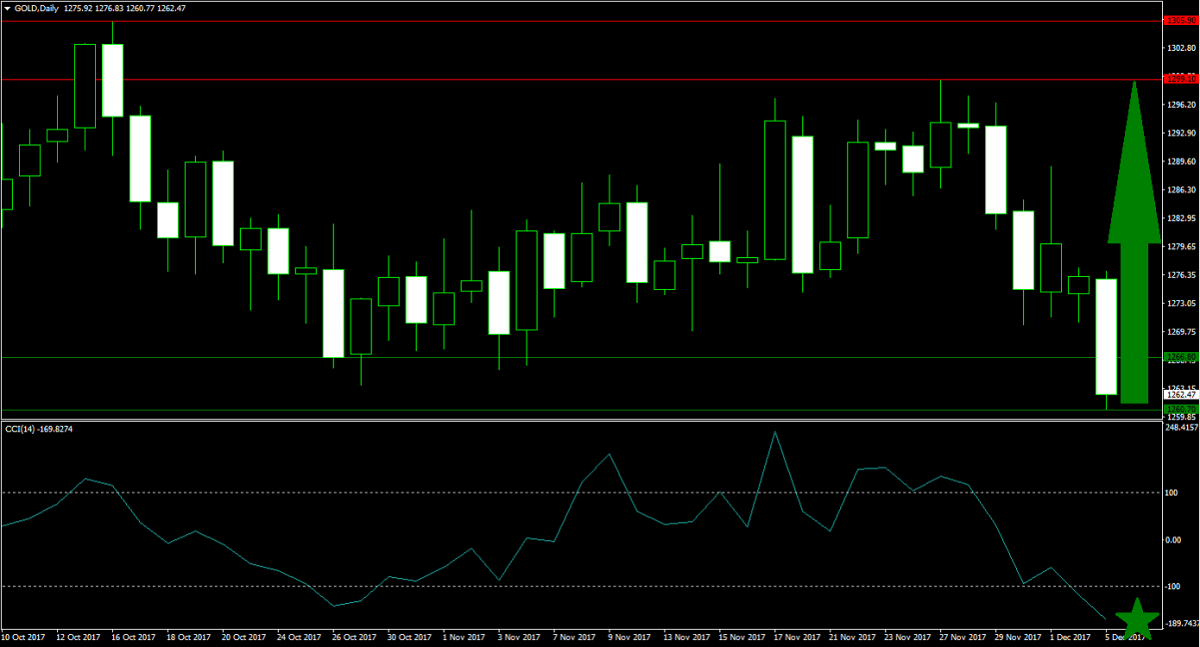

Forex Profit Set-Up #1; Buy Gold - D1 Time-Frame

Gold will be the biggest benefactor of any negative impacts of quantitative reductions and also offers a great currency hedge against interest rate adjustments. This commodity plunged from its resistance area into its support area, but further downside pressure is fading as uncertainty is on the rise. Should the current support area hold a further decline, forex traders should expect a reversal of at least 50% from the most recent contraction in price action.

The CCI has accelerated below the -100 mark which signals an extreme oversold condition. A sideways trend may emerge as further bearish pressures are being depleted and a breakout above the -100 mark warrants buy orders. Open your PaxForex trading account and hedge your forex positions with this long Gold trade.

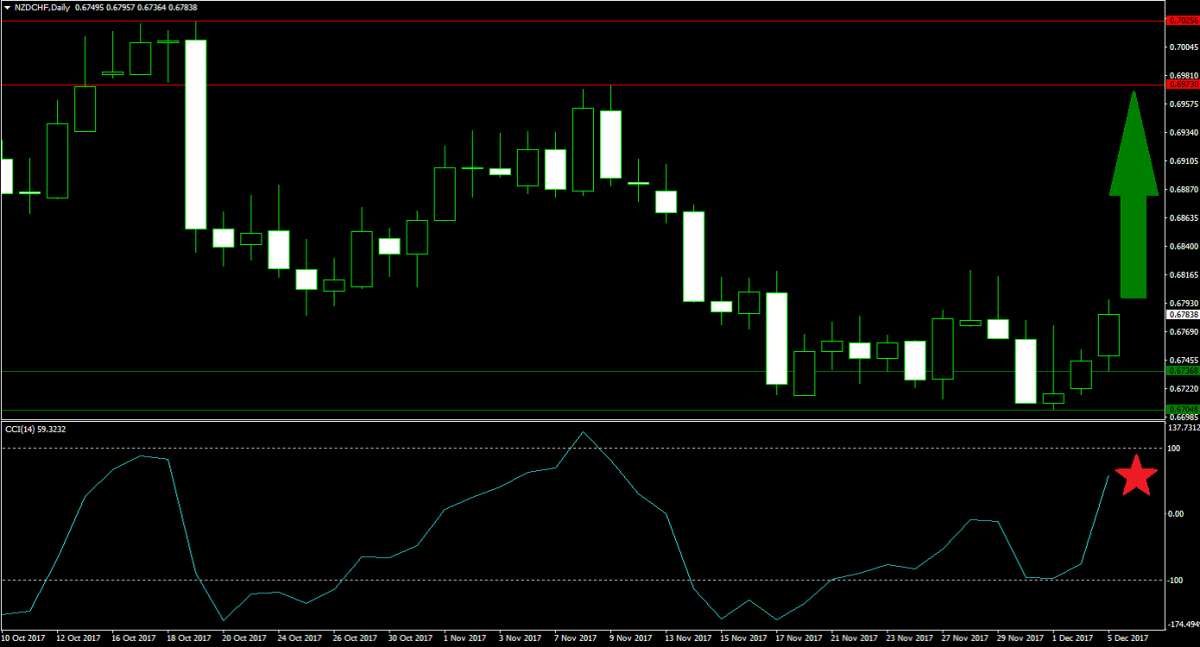

Forex Profit Set-Up #1; Buy NZDCHF - D1 Time-Frame

This is an interesting trade for everyone extremely positive on the global growth outlook as well as on how central banks will maneuver through their balance sheet reductions as well as interest rate increases. A positive global impact will see an increase in commodity demand and therefore lift the New Zealand Dollar. This trade has already started to advance following a breakout above its strong support area and the trend is predicted to accelerate to the upside.

Given the breakout, the CCI has also moved correspondingly and is currently well above the 0 mark. Conservative traders may wish to wait for a minor pull-back in the CCI to below 50 before entering their long positions. Download your MT4 platform now and add this currency pair to your forex portfolio.

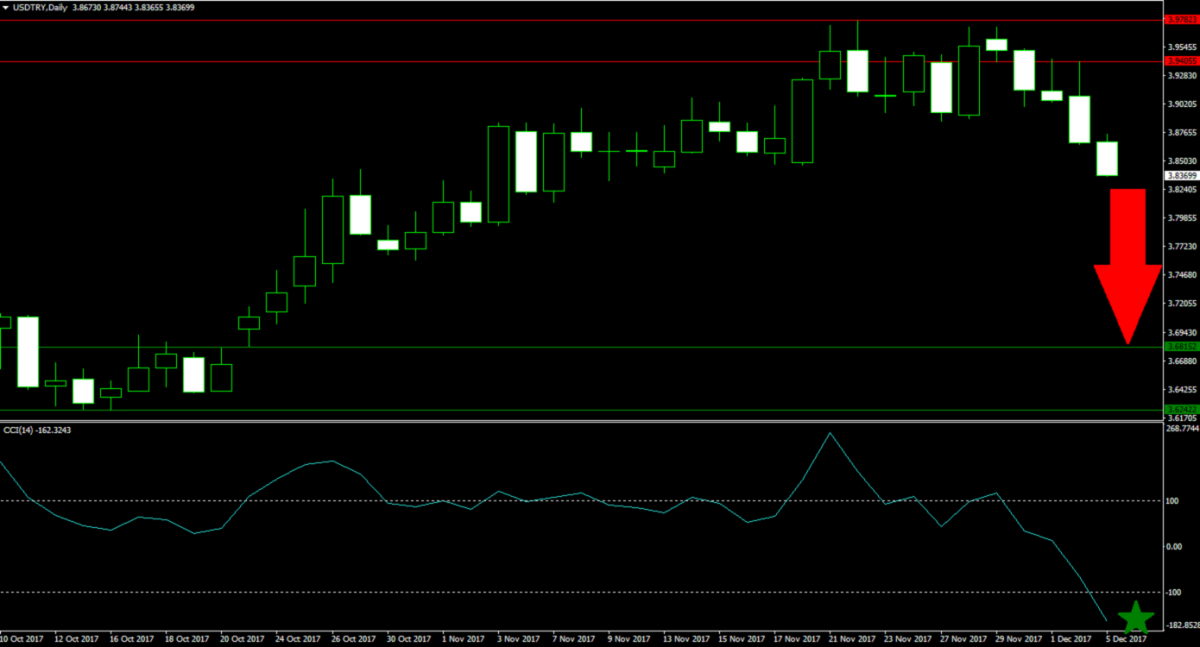

Forex Profit Set-Up #1; Sell USDTRY - D1 Time-Frame

This currency pair was rejected from a further advance with a double top formation inside of a very strong horizontal resistance area which resulted in a breakdown. This has spiked bearish pressures and the USDTRY is bound to extend its decline. The Turkish central bank is acting more favourable for a stronger Lira than the US central bank is for a stronger US Dollar which further adds to bearish pressures in this pair over the medium-term. Forex traders are advised to sell any potential short-term spikes in price action.

The CCI has collapsed into extreme oversold territory and is currently trading well below the -100 mark. A minor counter-trend reversal should be expected which will create good short entry opportunities for this currency pair. Trade with PaxForex and enjoy the same trading conditions professional forex traders enjoy.

To receive new articles instantly Subscribe to updates.