Memories of the January 3rd 2019 Japanese Yen mini crash, which impacted the Australian Dollar as well, barely faded when forex traders are reminded that fluctuations in the world’s most liquid market can be drastic. The January 3rd mini crash and recovery didn’t leave any permanent damage and neither did yesterday’s mini crash in the Swiss Franc. The USDCHF initially spiked from 1.0004 to 1.0096, then reversed direction to dip below parity and eventually resumed its path to the upside. Today it extended its gains and may challenge yesterday’s intra-day high, the weakest reading for the Swiss Franc against the US Dollar since last November, later this week.

Yesterday’s price gyration totalled 110 pips, almost twice 2019’s average 56 pips. The Swiss National Bank, know for its forex market transactions, didn’t comment on the mini flash crash. The conditions for yesterday’s crash and the one from January 3rd were identical. A Japanese holiday which created a low volume, low liquidity market for Asian traders. In these conditions it doesn’t take much to create wild price swings which are often reversed. In many cases the entire round-trip could last only a few minutes and in most cases normal trading will resume.

NAB Senior FX Strategist, Rodrigo Catril, noted that “Lack of liquidity is a common factor in these events. Traders and strategists now have Japan holiday calendars printed in a big font at their desk!” Some blame the initiator of the mini crash on a computer entry error which then send different algorithms chasing price action in a low liquidity market. Saxo Capital Strategist Eleanor Creagh added that “It’s like a mini flash crash. It’s a combination of low liquidity and Japan on public holiday that’s driven the move.” Events like this become more frequent which has some analysts worried.

The British Pound had a wild 6% day back in October of 2016 while the South African Rand took forex traders for a 9% ride in January of the same year. Those events often take only a few minutes, but that is more then enough to cause heavy damage in forex portfolios, especially those who are not properly managed. Take your first step into a market beating portfolio by opening your PaxForex Trading Account!

After this year’s Australian Dollar crash, the RBA commissioned a report into the matter of flash crashes. It pointed out low liquidity markets after the close of the New York trading session and before the start of the Tokyo trading session as the prime candidate for such an event. The RBA concluded that “While the flash event of 3 January did not lead to wider disruption, it adds to a growing list of extremely sharp moves in foreign exchange (and other asset) markets. These events are likely to owe in part to key changes in the structure of markets more broadly over the past decade; for example, the make-up and behaviour of principals, intermediating agents and trading platforms.” Another month, another mini crash and three forex trades to crash your doubts about profitable forex trading!

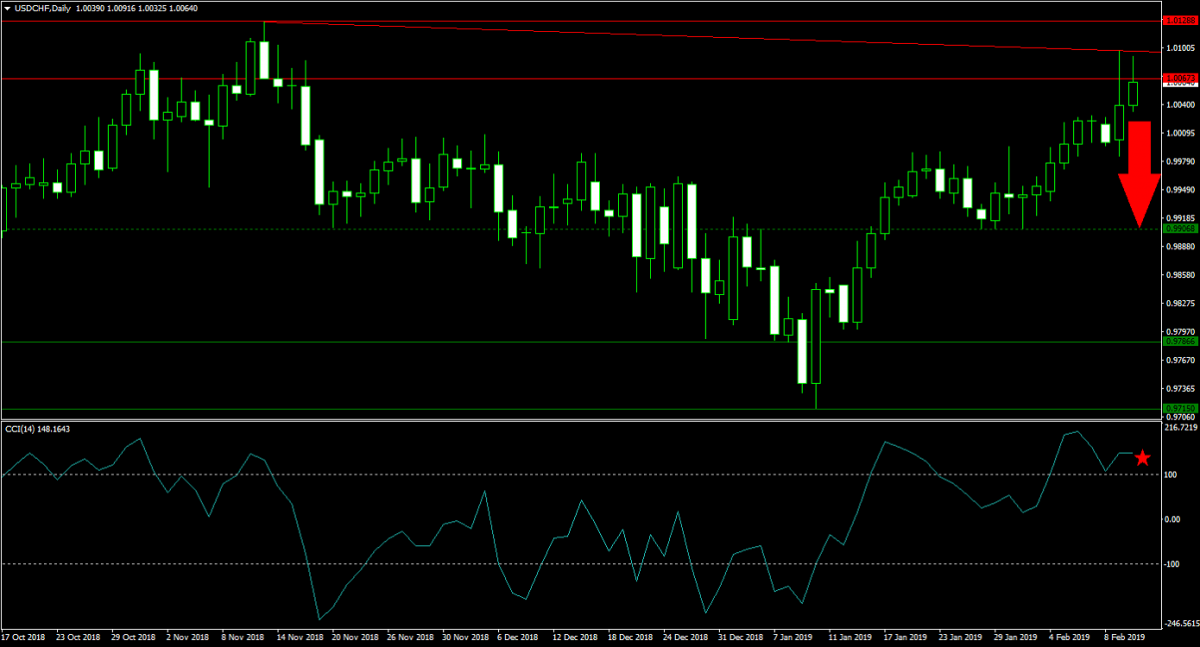

Forex Profit Set-Up #1; Sell USDCHF - D1 Time-Frame

The mini crash in the Swiss Franc may have lasted only a few minutes, but it was enough to take the USDCHF into its horizontal resistance area. As price action crossed above the lower band, bullish momentum faded and this currency pair did set a lower high which resulted in the formation of a primary descending resistance level. The USDCHF quickly reversed back down and is now trading below its horizontal resistance area from where more downside is expected. Forex traders are advised to sell the rallies into its primary descending resistance level.

The CCI is trading in extreme overbought territory, but reversed from its peak as bullish momentum is fading. This technical indicator is expected to drop below 100 which may ignite a sell-off on the back of profit taking. Download your PaxForex MT4 Trading Platform now and join our growing community of profitable forex traders.

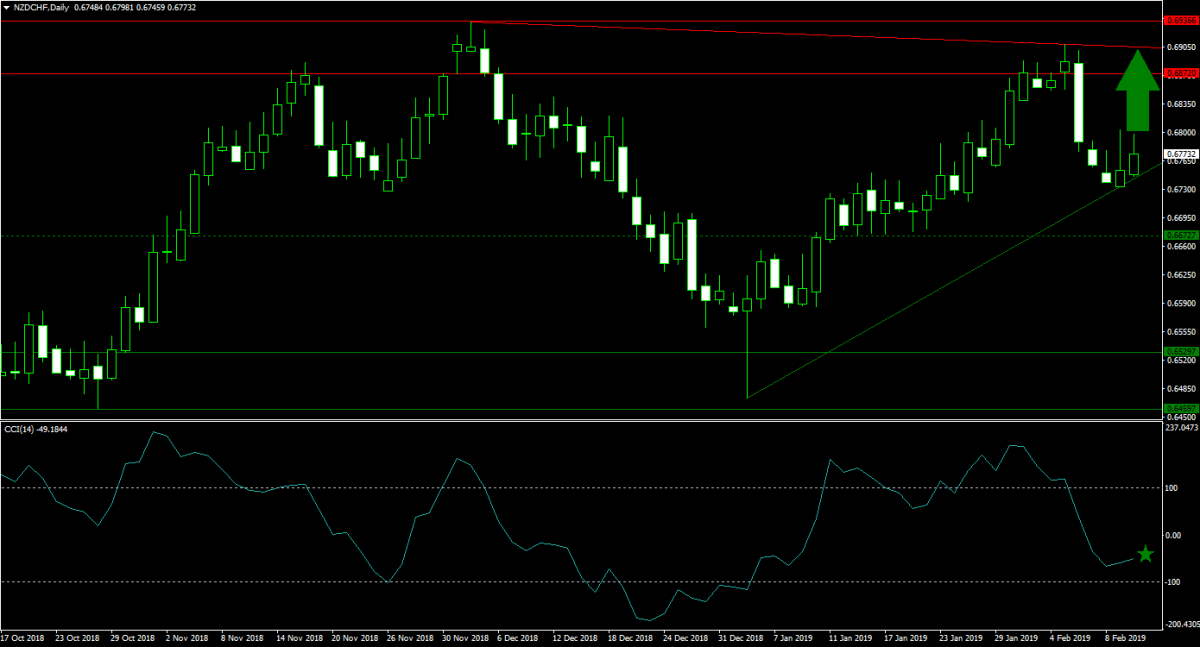

Forex Profit Set-Up #2; Buy NZDCHF - D1 Time-Frame

Prior to the mini crash, the NZDCHF was already in the midst of a profit taking sell-off after last week’s disappointing New Zealand employment report. Yesterday’s price action had little impact on the overall trend as this currency pair was stabilizing at its primary ascending support level. The emergence of an inverted hammer confirmed the end of the sell-off. The NZDCHF is now anticipated to accelerate back into its horizontal resistance area where its primary descending resistance level awaits. Buying the dips from current levels is favored.

The CCI dropped from extreme overbought conditions, but the sell-off did not drag this momentum indicator below the -100 mark and into extreme oversold territory. Momentum may quickly recover and push above 0 for a bullish momentum crossover. Subscribe to the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market; earn over 500 pips per month in profits.

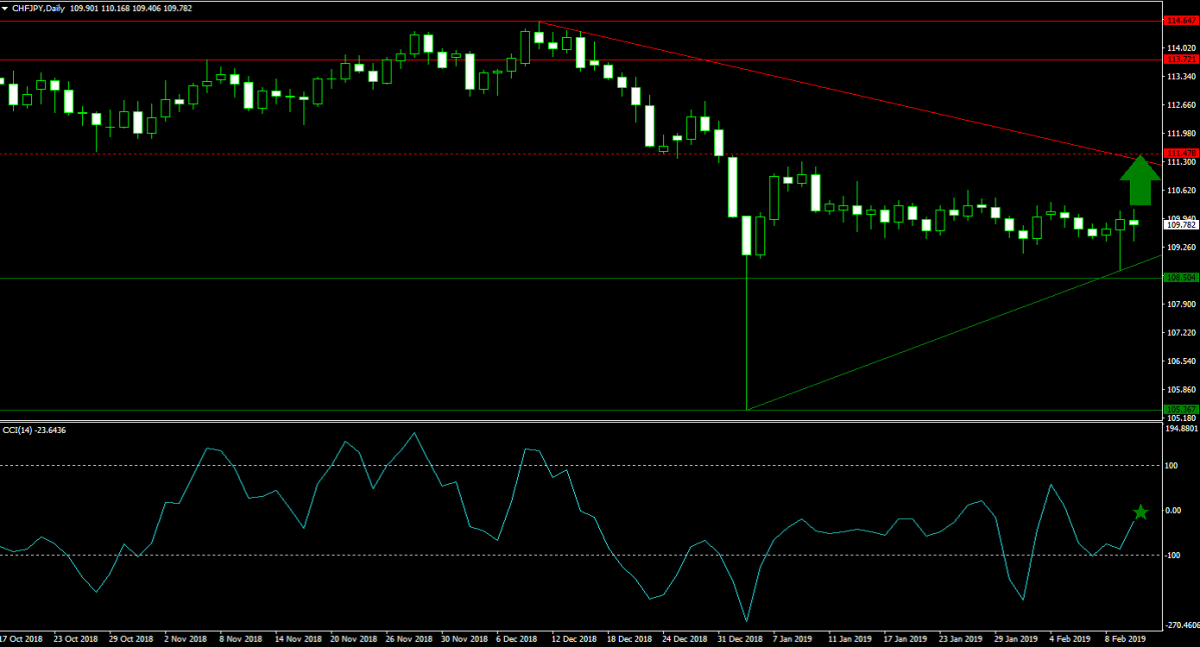

Forex Profit Set-Up #3; Buy CHFJPY - D1 Time-Frame

This currency pairs pegs the two flash crash candidates against each other, but this is not the only trait they share. Both currencies are considered safe haven currencies and following the January 3rd 2019 crash, price action has been confined to a narrow trading range with a bearish bias. The CHFJPY is now trapped between its primary descending resistance level and its primary ascending support level with an increase in bullish momentum. A spike into its next horizontal resistance level is expected. Forex traders are recommended to buy the dips down to its primary ascending support level.

The CCI briefly dipped into extreme oversold territory, but has since bounced off of its low. The acceleration in bullish momentum is expected to carry this indicator above the 0 mark from where a breakout in price action is possible. Follow the PaxForex Daily Forex Technical Analysis and copy the recommended trades of our expert analysts into your own account; grow your portfolio trade-by-trade.

To receive new articles instantly Subscribe to updates.