The US and China are in the early stages of a trade war which will increase volatility as well as uncertainty about how the US Dollar and the Chinese Yuan will trade, at least in the short-term. It will be harder for analysts to filter through the tweets of US President Trump and gauge a counter reaction by Chinese President Xi. Some forex traders may want to reduce their exposure to those currencies until more details become available. The funds which will flow out of higher volatile currencies will look for another trade in the forex space.

The Euro and the British Pound are heavily impacted by how Brexit will shape up over the course of 2018. The Russian Ruble is under pressure from international sanctions, the Indian Rupee is caught in political actions which may impact the health of India’s finance sector and the Brazilian Real is set to lose as the global economy is slowing. The Canadian Dollar and the Mexican Peso have to deal with changes to NAFTA while the Australian Dollar and the New Zealand Dollar will face the crunch of a decrease in global trade.

While all the geopolitical events and uncertainties will create trading opportunities without a doubt, it is wise to counter exposure to highly volatile price action moves with more stable currencies in order to decrease risk while maintaining profit momentum. The Japanese Yen will remain the top carry trade currency and the Swiss Franc will benefit from risk reduction across global forex portfolios, but the Scandinavian currencies are set for a boost during the expected reallocation of funds.

PaxForex offers a wide range of assets which allows traders to create a dynamic trading portfolio. Plant the seeds of future profits today by opening your PaxForex Trading Account now. Take advantage of the profitable combination created through the proper mix of major currency pairs, topped off with a selection of minor currency pairs and seasoned with exotic currency pairs. Find out why professional traders manage their accounts at PaxForex.

As global volatility is on the rise across financial markets, the Swedish Krona is set to reverse month’s of losses which made it the world’s worst performing major currency so far in 2018. Earlier in April a new eight-year low was recorded, but price action started to recover together with the economic prospects of Sweden. The Riksbank is also rumored to increase interest rates for the first time in seven years which makes inflation data even more important. The Danish Kroner is set to ride the wave higher as well, but the Norwegian Krone may struggle which makes it a natural hedge. Here are 3 Scandinavian trades for your forex portfolio.

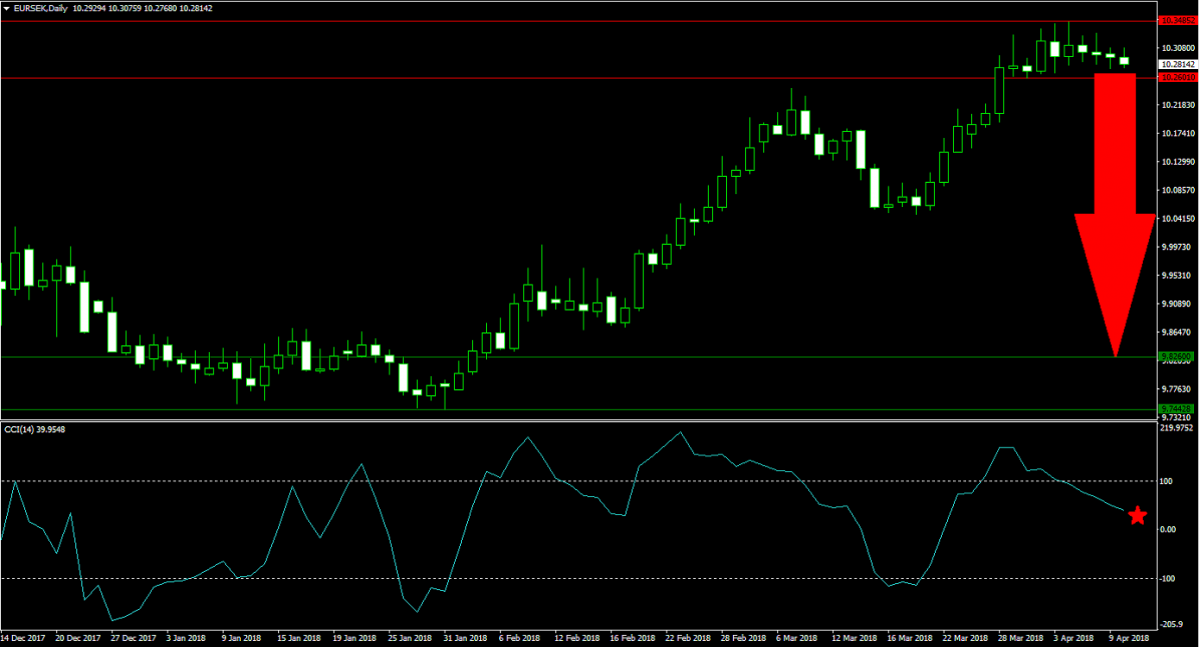

Forex Profit Set-Up #1; Sell EURSEK - D1 Time-Frame

The EURSEK is currently trading inside its horizontal resistance area with an increase in downside pressure. A breakdown below the lower band of its resistance area is set to result in an increase in sell orders. Profit taking is also expected to occur which will further add bearish momentum in this currency pair. A full reversal down into its horizontal support area is likely and forex traders should spread their sell orders inside the horizontal resistance area.

The CCI already retreated from extreme overbought conditions above 100 and is now on a downward trajectory to 0. A move below will further increase bearish pressures in the EURSEK. Take advantage of the PaxForex Daily Forex Technical Analysis and enter the most profitable technical trades to your trading account.

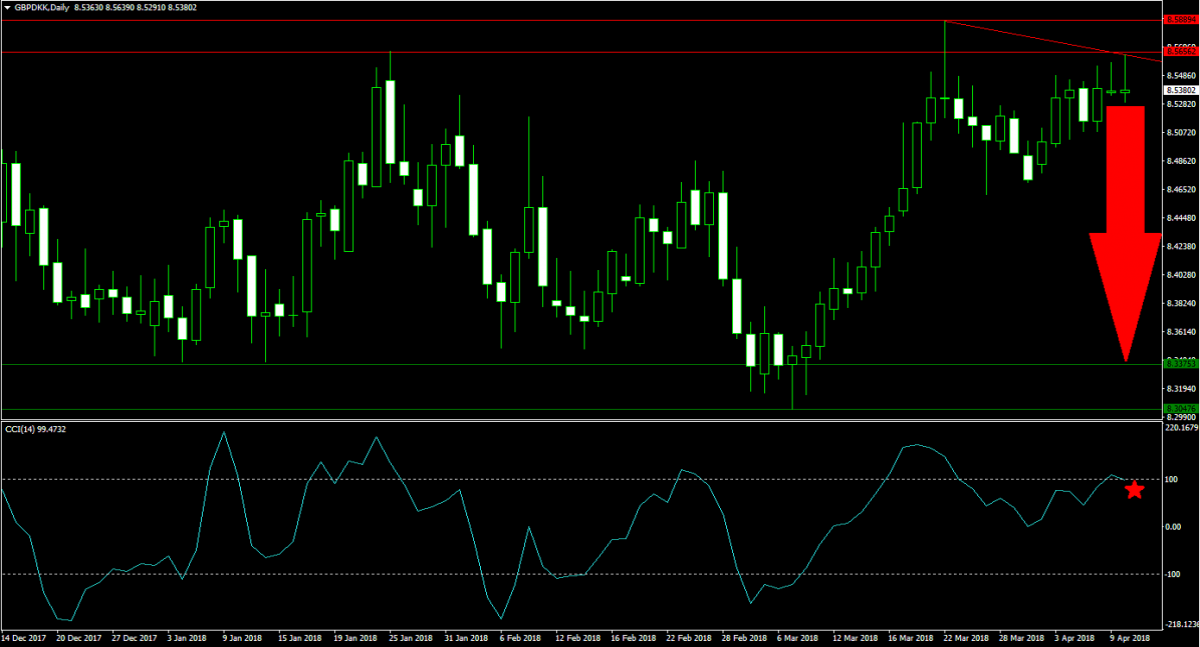

Forex Profit Set-Up #2; Sell GBPDKK - D1 Time-Frame

This currency pair already completed a breakdown below its horizontal resistance area and was, today, again rejected by the lower band of its resistance area. A descending resistance level formed as a result and is now adding more bearish pressure to the GBPDKK. A combination of profit taking as well as bullish opinion shift on the prospects of the Danish Kroner is set to push price action to the downside. Forex traders are advised to sell price spikes in the GBPDKK into the descending resistance level.

The CCI followed price action moves and is currently trading just inside extreme overbought territory. This technical indicator is expected to decelerate from current levels which will confirm a rise in bearish momentum. Earn over 500 pips per month with the PaxForex Daily Fundamental Analysis where our expert analysts outline each trading day’s most important fundamental trades.

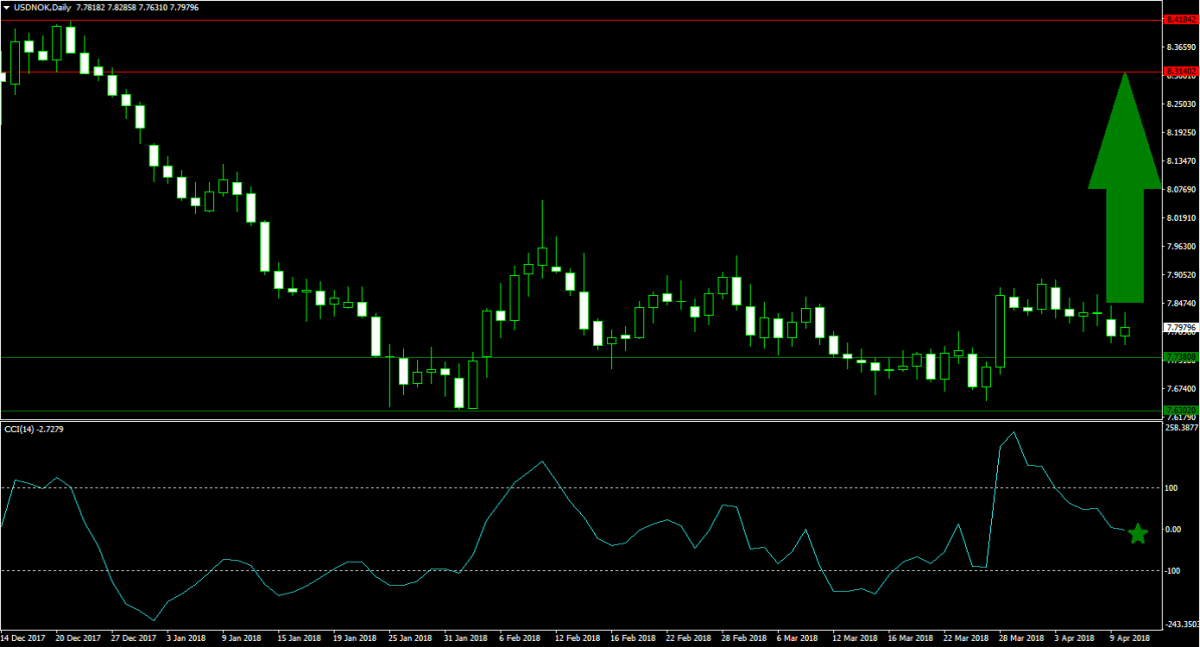

Forex Profit Set-Up #3; Buy USDNOK - D1 Time-Frame

It is always smart to hedge your forex account and the USDNOK long recommendation is a great, natural hedge for the EURSEK and GBPDKK short recommendations. This currency pair completed a breakout above its horizontal support area and is now trading just above the upper band of this support level. There is little resistance in the path for the USDNOK to accelerate back into its horizontal resistance area. Forex traders are recommended to buy the dips.

The CCI spiked from extreme oversold territory into extreme overbought conditions, but has now retreated into neutral levels above the 0 mark. A move back towards 100 is expected to follow as price action is set to advance. Make a deposit into your PaxForex trading account now and take advantage of this currency pair before the next move unfolds.