The US Dollar has contracted against every other currency in the G-10 basket since the inauguration of President Trump last year in January. US Treasury Secretary Mnuchin arrived at the World Economic Forum in Davos yesterday in order to prepare the attendees for President Trump’s ‘America First’ policy on a global stage. Traditionally, the US administration has always endorsed and promoted a strong US Dollar policy, but this time around the messages has changed which could pave the way for what many believe to be the start of trade wars this year.

Mnuchin stated that ‘Obviously a weaker dollar is good for us as it relates to trade and opportunities. The currency’s short term value is not a concern of ours at all. Longer term, the strength of the dollar is a reflection of the strength of the U.S. economy and the fact that it is and will continue to be the primary currency in terms of the reserve currency.’ A weak US Dollar makes exports more attractive to other countries which may opt to take advantage of US goods and services. On the other hand it makes imports more expensive domestically which could result in corporations and consumers to shop at home and not seek products and services from other countries.

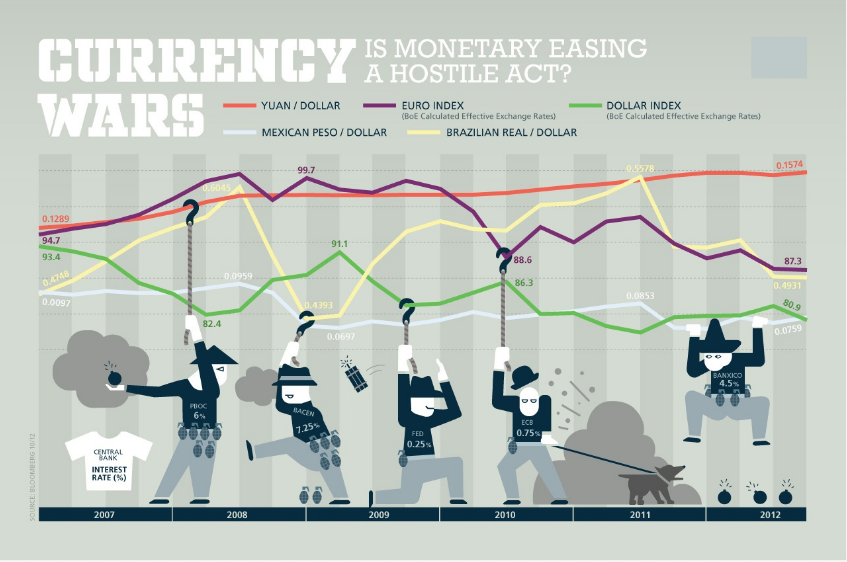

This is in line with President Trump’s ‘America First’ message. The public endorsement by the US administration for a weak US Dollar is expected to draw retaliation by other countries who could apply tariffs to US goods and services in order to discourage their consumption. A war of words may escalate, as soon as this year, into trade and currency wars with other members of the G-10. Valentin Marinov, Credit Agricole CIP strategist, issued a note to clients stating that ‘This is a further break away from the ‘strong USD’ mantra launched in the mid-1990s by Clinton’s Treasury Secretary Rubin and adhered to by subsequent Treasury leaders. Inevitably, the Administration’s vocal preference for a weak dollar is likely to raise the risk of global currency wars.’

The forex market will experience a sharp increase in volatility with wider price swings as a result of currency wars and central bank interference. This will also create many great trading opportunities with huge profit potential. Open your PaxForex Trading Account today and earn more pips per trade. Find out why more and more successful forex traders call PaxForex their home.

US Commerce Secretary Wilbur Ross added that ‘Trade wars are fought every single day.So a trade war has been in place for quite a little while, the difference is the U.S. troops are now coming to the rampart.’ The first sign of caution can be found in IMF Director Lagarde’s comment where she stated that ‘I really hope that Secretary Mnuchin has a chance to clarify exactly what he said. As the rhetoric increases and the words sharpen, the profit opportunities in forex increase as well. Here are our three forex trades to profit from the Mnuchin endorsement of a weak US Dollar and the expected continued down-trend.

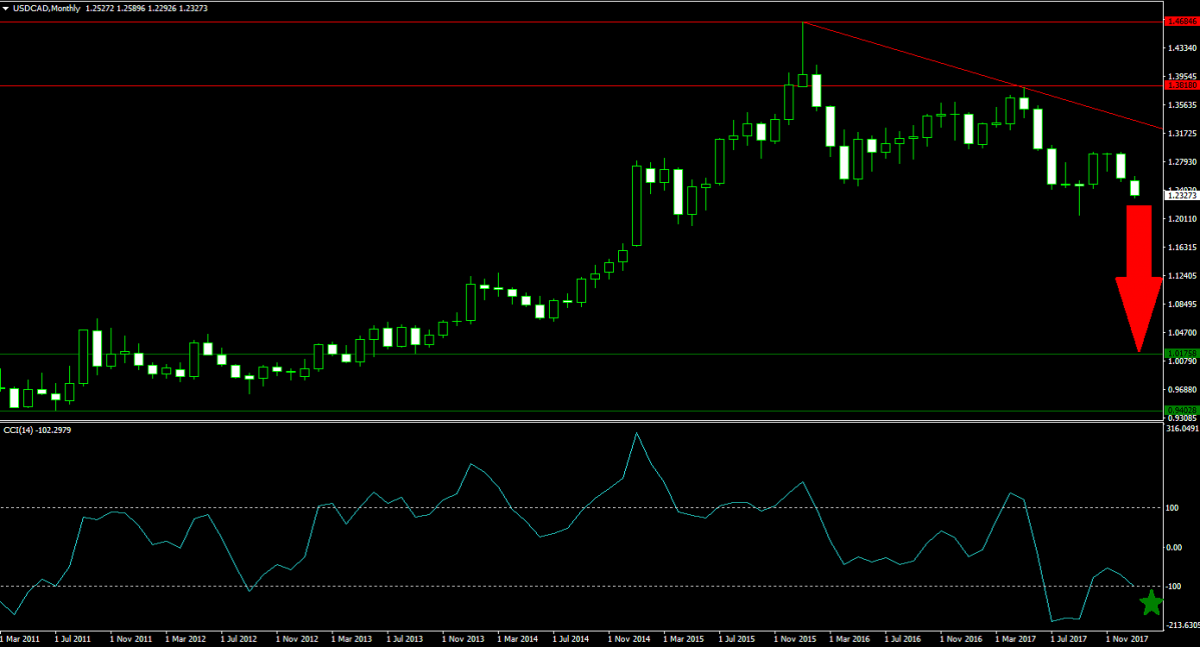

Forex Profit Set-Up #1; Sell USDCAD - MN Time-Frame

The USDCAD is currently in the middle of its corrective phase after its horizontal resistance area rejected a further advance. The rejection led to a breakdown, which was followed by a second attempt to advance. After the second rejection was confirmed, price action resumed its decline which is now further enhanced by bearish pressures provided by its descending resistance level. Forex traders are advised to sell the rallies as there is more downside potential in this trade at the same time upside potential is being degraded.

The CCI is trading above and below the -100 level which indicates extreme oversold conditions, but as price action is predicted to contract further this momentum indicator is also set for new lows. Any minor bounce will take the CCI above the -100 mark which would represents a solid entry. Download your MT4 Trading Platform now and enter profit from this trade.

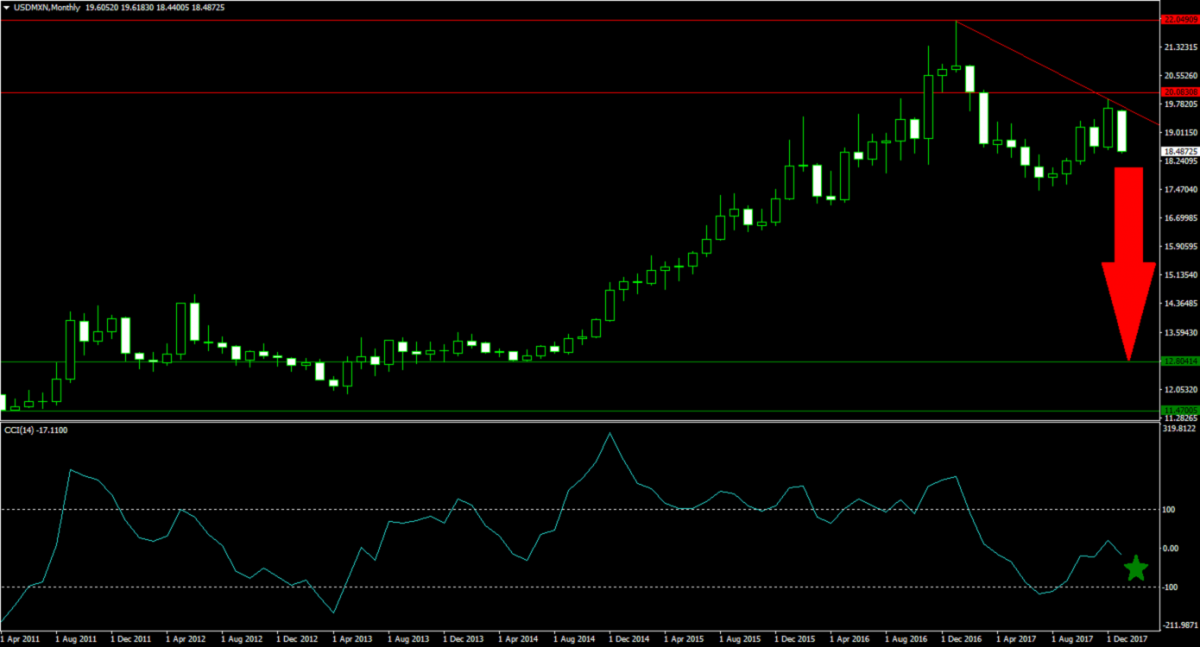

Forex Profit Set-Up #2; Sell USDMXN - MN Time-Frame

The USDMXN shows a similar technical trade set-up as the USDCAD, but with a larger degree of volatility and profit potential. It pares well together and completed the NAFTA trade which the US wants to renegotiate. The USDMXN is in an earlier stage than the USDCAD trade and therefore comes with more downside potential. The descending resistance level is applying downside pressures which is set to attract more short-positions, especially as more NAFTA related details become public knowledge. This currency pair is set to reverse the gains it enjoyed during the last US presidential election.

The CCI is trading in neutral territory after a collapse in this momentum indicator took it from above 100 to below -100 from it was able to recover roughly half its move. Forex traders should now account for a resumption of the deterioration in bullish momentum and the increase in bearish pressures. Make a deposit into your PaxForex trading account now and earn more pips.

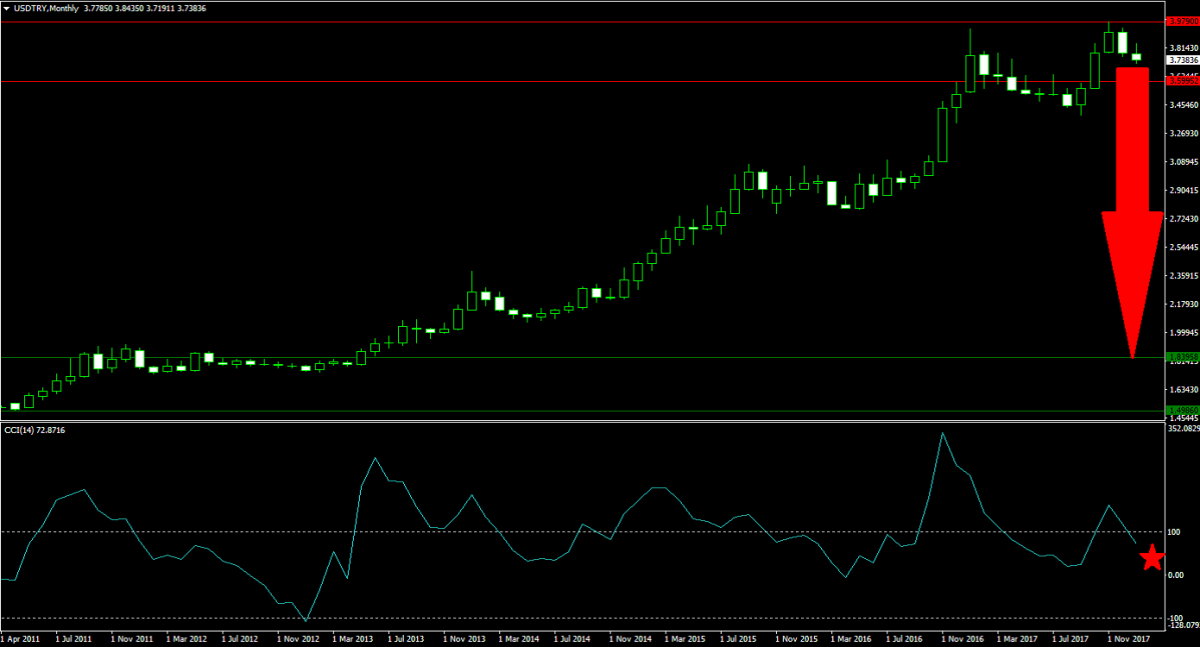

Forex Profit Set-Up #3; Sell USDTRY - MN Time-Frame

The USDTRY is at the early stages of what could be a very sharp correction. Price action is currently trading inside of its horizontal resistance area from where bullish momentum is fading. A breakdown is predicted to result in profit taking which could feed on itself with new sell orders flowing into this trade. Turkey has been very vocal about its dissatisfaction with US trade policy which makes this an even more interesting currency trade. This currency pair could see a 0% retracement of its previous advance.

The CCI has formed a negative divergence and just completed a breakdown below the 100 mark which took it away from extreme overbought conditions. A move below the 0 level will confirm the change in momentum from bullish to bearish. Before you add this trade to your forex account, make sure to take a look at the PaxForex Promotions in order to prepare your account for the 2018 currency wars.

To receive new articles instantly Subscribe to updates.