The most profitable forex traders understand that financial markets are connected and that in order to maximize profits it is important to look at all aspects. Many forex traders, especially new ones, only scan their MT4 forex charts in order to find a profitable trade. This often only gives them a part of the bigger picture which in many cases results in losses and unexplained price action moves. Those traders who think outside-the-box can and will find trades which will yield superior returns than those who are stuck in one part of the financial markets. The biggest story in 2018 so far has been the bond market which may lead the next major move in financial markets.

Successful traders usually follow developments in the forex market, the equity markets and the bond markets. The equity market has been in a long bull market with valuation stretched thin and limited upside potential from current levels. 2018 represented the best start in recent history which makes profit taking a very likely next step. As money flows out from one asset class, it usually flows into another one in order to keep the profit stream alive. The re-allocation of assets is normal and with equity markets near all-time highs, the bond market received an extra dose of attention from traders all around the world.

The US bond market continued to contract which send yields, which move opposite of price, to 2.7% during yesterday’s trading session. This was the highest level since 2014 and the bond rout is set to continue. At the same time, bonds in Europe are moving higher which send their yields lower. This is in line with the opinion that while the US markets, the US Dollar included, are on a downward trajectory while the European Union and the Euro have more room to advance. CMC Markets Analysts Michael Hewson noted that ‘ An acceleration in the selloff of global bond markets appears to be starting to let some of the air out of the recent rally in global equity markets. U.S. markets suffered their worst one day fall this year, though sharp falls in tech stocks also contributed.’

PaxForex offers all its traders the right trading environment together with the proper market analysis in order to allow its traders to grow their trading portfolios in all market scenarios. Download our MT4 Trading Platform today and access a wide range of assets and profit from our expert analysis. Earn more pips per trade at PaxForex thanks to tight spreads and find out why more professional traders call PaxForex their home.

The continued sell-off in bonds will have an impact on currencies as well. While the US Dollar has been in a corrective phase and the Euro, British Pound as well as the Japanese Yen have advanced. It is natural that there will be a slight counter-trend reversal before the longer term trend resumes. Forex traders who missed the previous moves should monitor price action and use the expected count-trend rallies as entry levels. The sell-off in US bonds has pushed the US Dollar higher which is creating new short opportunities. The advance in European bonds has depressed the Euro and the British Pound which is creating buying opportunities. The bond market has led 2018 as far as trading opportunities is concerned and is set to continue to do so. Here are our 3 forex trades clued from the bond markets.

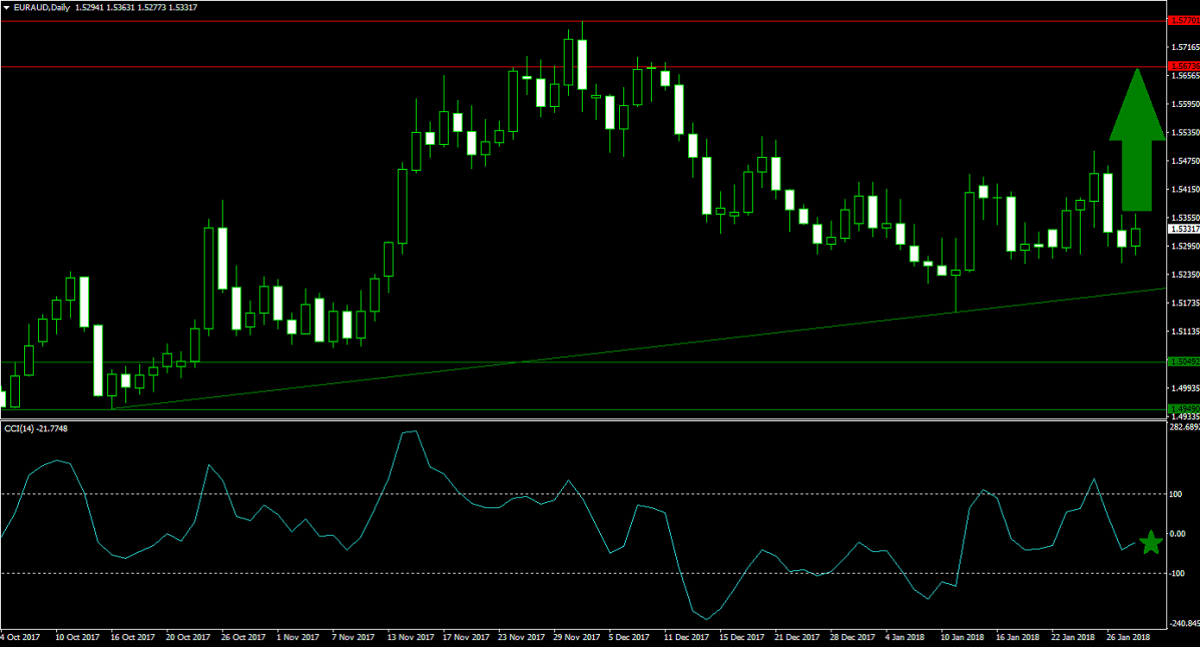

Forex Profit Set-Up #1; Buy EURAUD - D1 Time-Frame

The Euro has enjoyed the power of positive economic reports and the healthiest expansion in several years. Those who missed the sharp advance, will have a chance to get in on the next advance against the Australian Dollar. The EURAUD has corrected from its horizontal resistance area down into its ascending support level which originated from the low point of its horizontal support area. Price action was able to stabilize and is now poised to retrace its most recent correction. Forex traders should seek long entries around the 1.5300 mark.

The CCI has dropped from extreme overbought conditions, above a reading of 100, and also dipped below the 0 level. A move above 0 is set confirm a bullish momentum change and invite more buy orders into this currency pair. Learn how you can earn over 500 pips per month with our PaxForex Daily Fundamental Analysis.

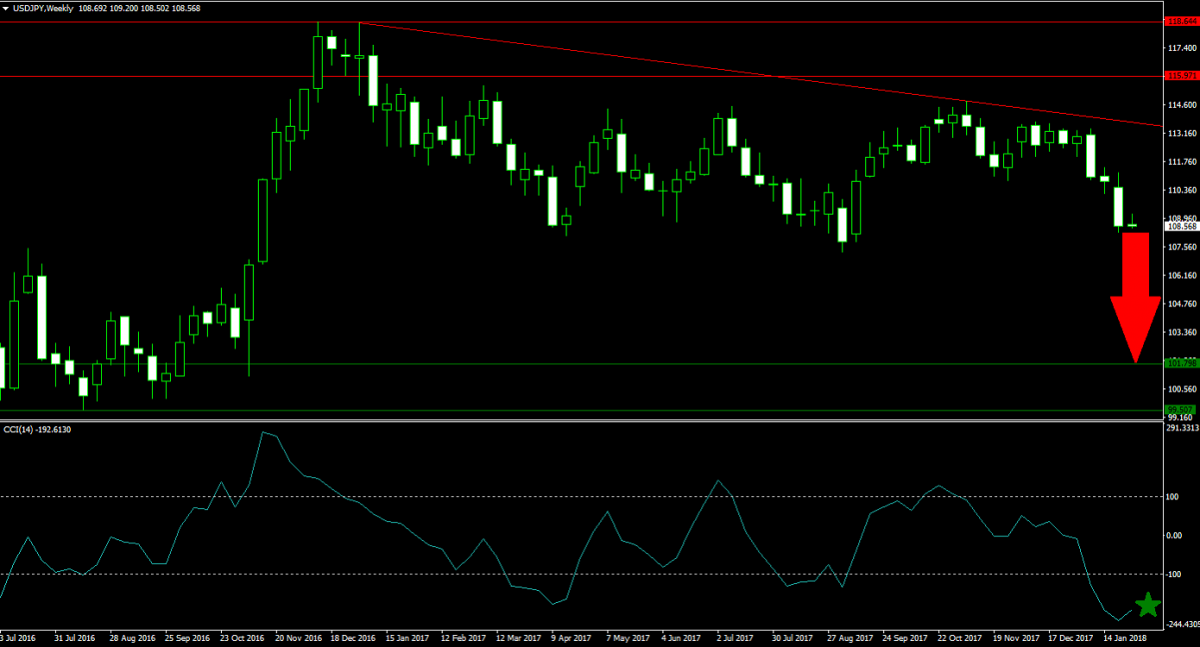

Forex Profit Set-Up #2; Sell USDJPY - W1 Time-Frame

As global uncertainty rises and the prospects of an equity market correction increases, investors from all asset classes seek safe haven trades. When it comes to forex, the Japanese Yen is the top safe haven trade and usually advances the more fear is present. As the bond market resumes its move lower and geopolitical risks increase, the Japanese currency is set to benefit regardless of what the Bank of Japan has in mind. The USDJPY broke down below its horizontal resistance area and is being pressured to the downside by its descending resistance level. Forex traders should sell any counter-trend rally from current levels up to the 110.000 level.

The CCI, a momentum indicator, has dropped below -100 which signals an extreme oversold conditions. Any short-covering rally is set to take this indicator above the -100 level which is in-line with the above mentioned recommendation to sell rallies. The PaxForex Daily Forex Technical Analysis section offers traders the best trades each day from a technical perspective for a well balanced portfolio.

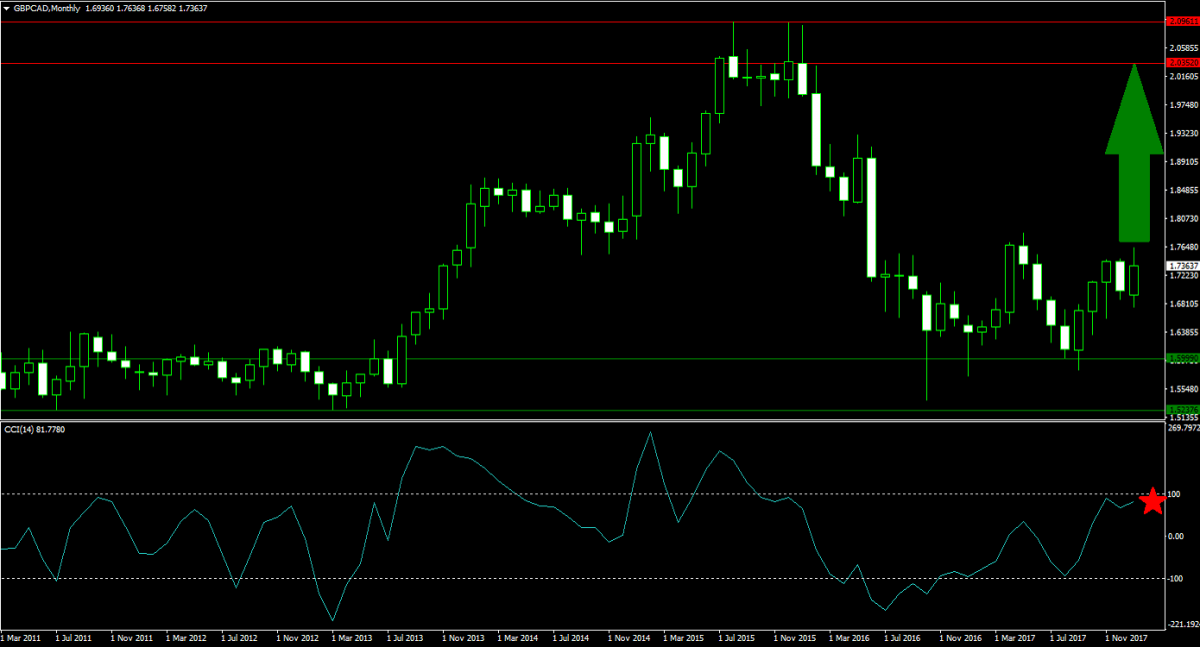

Forex Profit Set-Up #3; Buy GBPCAD - MN Time-Frame

Price action in the GBPCAD has just ended its move to the downside and is now trending sideways as bearish momentum is fading. The breakout from its horizontal support area has forced a momentum shift to bullish and this currency pair is now ready to retrace its correction with a rally back into its horizontal resistance area. Any dip below 1.7200 should be take advantage off as this trade offers plenty of upside potential with limited downside risk. The British Pound is also set to benefit from a rise in inflation in the UK which could lead to more interest rate increases.

The CCI has moved away from extreme overbought conditions, identified with a reading above 100, and as price action retreats from current levels down to the 1.7200 mark the CCI is also bound to drift down towards the 0 mark which will combine for a great long entry opportunity. Open your PaxForex Trading Account today and add this trade to your portfolio before it accelerates to the upside.

To receive new articles instantly Subscribe to updates.