Most traders did not have inflation on their radar for almost one decade or since the last global financial crisis. Central banks in developed countries have embarked on large economic stimulus packages know as quantitative easing, slashed interest rates to near 0% and printed money. That is a terrible combination for anyone watching for inflation and inflationary pressures. Despite all of that, inflation has been subdued with occasional periods where deflation became a bigger threat to the global economic expansion than inflation. Now, inflation is staging a comeback and investors are paying attention the the forgotten harbinger of recessions.

Over the past few years most economies expanded, such as the Eurozone firing on all cylinders especially over the past twelve months. At the same time inflation gauges like the consumer price index (CPI) have not moved as many would have expected. The latest reading on the Eurozone annualized CPI actually decreased in January to 1.3% from December’s CPI of 1.4%. This is well below the unofficial ECB target of 2.0%. The CPI for the same period in the US was announced yesterday and clocked in at 2.1% annualized. The US Dollar remained under pressure while equity market initially plunged and later rallied. The UK CPI for January was reported at 3.0% annualized which could result in an interest rate increase sooner than the BOE is expected to announce.

Labor markets, especially in the US, have tightened over the same period. Usually a tight labor market results in wage pressures as it becomes harder for companies to find the right talent. Wages tend to increase in order to attract the best employees which leads to wage inflation. Despite an unemployment rate in the US below 5.0%, wages have barely advanced. Inflation outpaced wage increases for January in the US which results in consumer having less disposable income. US retail sales contracted last month. Over the past two weeks more investors have paid to the inflationary pictures, especially since bond yields on 10-Year Treasuries are marching towards 3.0%.

As inflation is on the rise, divergences will become evident. Volatility is set to spike and central banks will no longer move in unison. This is the first step back to a normalized monetary environment which creates great trading opportunities for forex traders. Open your PaxForex trading account today and earn more pips per trade. Find out why more successful forex traders call PaxForex their home every day!

The US Dollar remains on its path lower while the Japanese Yen advances. This is a very common practice when uncertainty is on the rise or inflationary pressures gain attention. US Treasuries are putting downward pressure on the US Dollar and money is rotated out of higher risk assets into the save haven currency of choice, the Japanese Yen. Forex traders should be prepared for much more volatility ahead. Managing Director at Robert W. Baird & Co, Michael Antonelli, noted that 'We’ve been burned just last week, and now we step back up to the stove to cook again, and we’re nervous. With the memory of being burned, we recoil in horror.' Here are our 3 ways to profit from the inflation obsession.

Forex Profit Set-Up #1; Buy EURZAR - D1 Time-Frame

This currency pair came crashing down after it completed a move below its horizontal resistance area. The plunge resulted in the formation of a new horizontal support area which has been tested and confirmed since then. A sideways trend inside this area emerged which resulted in the decrease of selling pressure. The recent Euro rally passed the EURZAR which has now the chance to catch up with political turmoil in South Africa as a catalyst for a breakout. Forex traders should stagger their buy orders inside the 14.4750 and 14.9160 zone.

The CCI is currently trading deep inside extreme oversold condition, well below the -100 level, which is bound for a sharp reversal. The positive divergence in this indicator is expected to ignite a reversal and a breakout above -100 a sustained advance in the EURZAR. Fund your PaxForex Trading Account now and enter this currency pair to your portfolio before the advance unfolds.

Forex Profit Set-Up #2; Buy USDPLN - D1 Time-Frame

The USDPLN ended its correction after the breakout above its horizontal support area. Price action has reversed following the breakout and this currency pair is trading back inside of its horizontal support area for a second challenge to the validity of support. Forex traders should expect support levels to hold firm and bearish pressures to ebb. The next move for the USDPLN is set for a reversal of its correction with tremendous upside and limited downside risk. Buy orders 3.3055 and 3.6150 are strongly recommended.

The CCI, a momentum indicator, is trading near the -100 mark which identifies extreme oversold conditions. A series of lower lows is a bullish sign and confirms the expected decrease in selling pressure from current level. Earn over 500 pips with the PaxForex Daily Fundamental Analysis; let our expert analysts do the work ad cover the markets and all you need to do is copy the trades into your own forex trading account.

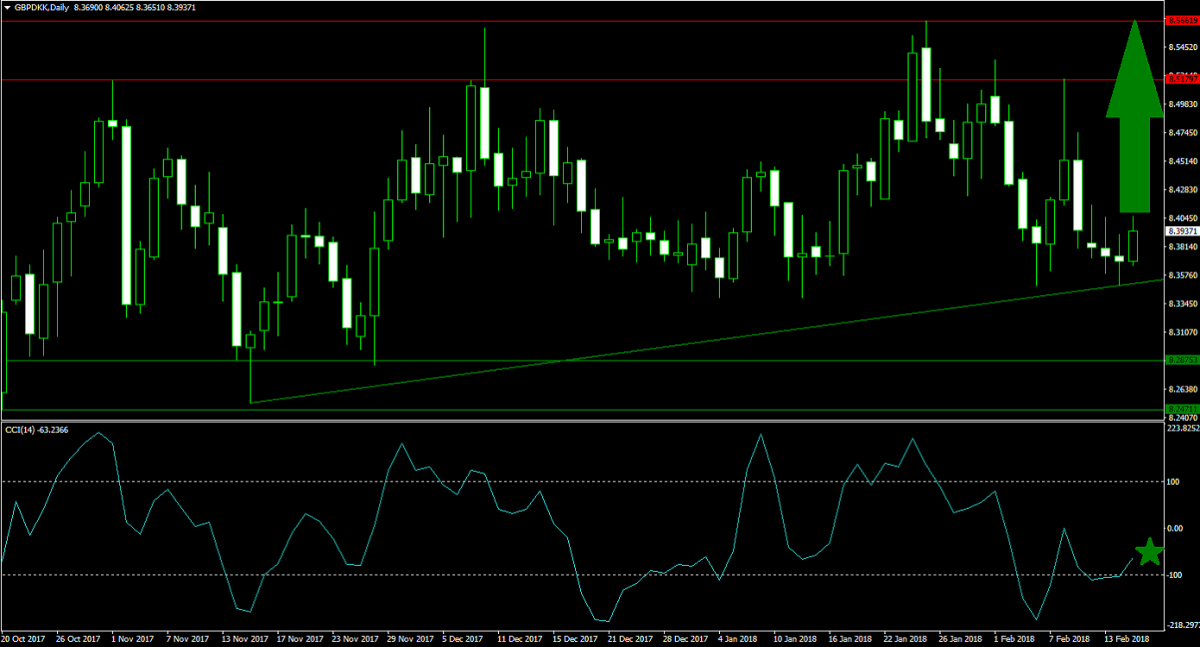

Forex Profit Set-Up #3; Buy GBPDKK - D1 Time-Frame

This trade offers forex traders a double dose of bullishness. The interest rate differential, partially due to inflationary pressures, is expected to increase which will boost the GBPDKK and gives traders the first-half of the buy recommendation. The technical picture delivers the second-half as an ascending support level is set to pressure this currency pair back into its horizontal resistance area following a brief pull-back. Forex traders should seek buying opportunities between 8.3500 and 8.4000 and look out for temporary dips in price action.

The CCI initially collapsed well below the -100 level which was followed by a quick breakout and another contraction which set a higher low. This momentum indicator has since completed a second breakout above -100 and is presumed to continue its move higher. PaxForex publishes a Daily Forex Technical Analysis to all traders which outlines the most lucrative forex trades based on technical indicators.

To receive new articles instantly Subscribe to updates.