Currency war, also known as competitive devaluation, is a condition in international affairs where countries compete against each other to achieve a relatively low exchange rate for their own currency. As the price to buy a country's currency falls so too does the price of exports, and Imports to the country become more expensive. So domestic industry, and thus employment, receives a boost in demand from both domestic and foreign markets. Competitive devaluation has been rare through most of history as countries have generally...

The currency markets of the world can be viewed as a wide ranging and constantly changing mix of current events. Due to the volatile nature of the world events and the constant shifting of supply and demand, the price of one currency in relation to another is always changing. No other market is affected so much by what is going on in the world as much as the forex market. With the forex market being such a global and inter-connected marketplace, events from all corners of the globe can have an immediate effect on exchange rates and currency...

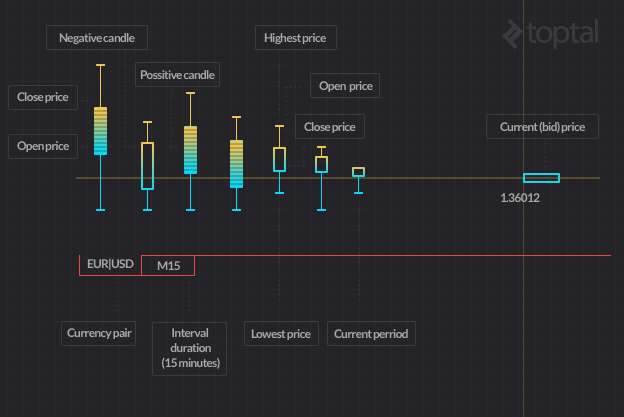

The foreign exchange market commonly referred to as the forex market is an international exchange for the trading of currencies. It allows investors from large banks to individuals and everyone in between to trade one currency for another. Each trade is both a purchase and a sale, as one currency is sold in order to buy another one. This duality means that currencies are not priced in any one currency but in relation to other currencies. In the world of finance, arbitrage is the practice of taking advantage of a state of imbalance between...

Nearly thirty years ago trading was characterized by trades conducted via telephone, institutional investors, opaque price information, a clear distinction between interdealer trading and dealer-customer trading and low market concentration. Today, technological advancements have transformed the market. Trades are primarily made via computers, allowing retail traders to enter the market, real-time streaming prices have led to greater transparency and the distinction between dealers and their most sophisticated customers has largely disappeared...

Spread betting is a derivative strategy, where participants do not actually own the underlying asset they bet on, such as a stock or commodity. Rather, spread bettors simply speculate on whether the asset's price will rise or fall using the prices offered to them by a broker. Key characteristics of spread betting include the use of leverage, the ability to go both long and short, the wide variety of markets available and tax benefits. As in stock market trading, two prices are quoted for spread bets - a price at which you can buy and a price...