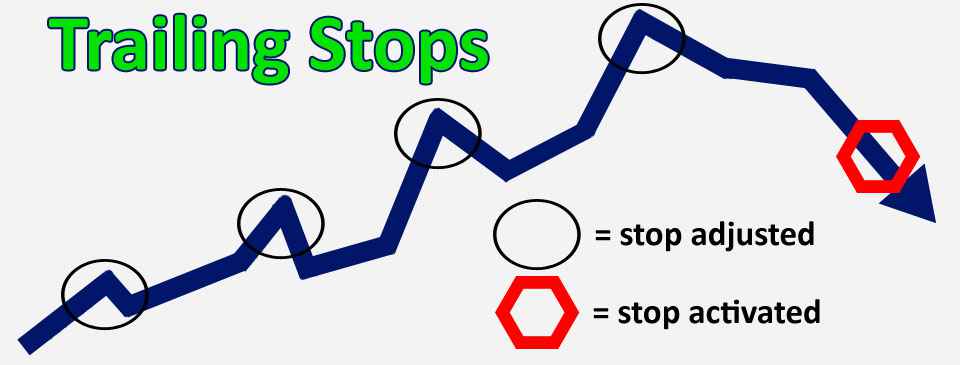

Online brokers offer various types of orders designed to protect investors from significant losses. Many traders have heard of the truism, 'cut your losses short, and let your profits run. However, if you are unfamiliar with a tool to help you implement this tried and true wisdom, it's time to familiarize yourself with the Trailing Stop. Trailing stops are a more advanced type of stop loss order that can reduce the risk on your trade as the trade progresses. Trailing stop is an order which major function is an automatic maintenance of open...

The features of the Meta Trader 4 and the cTrader platforms are very close. With both of them offering a wide range of indicators and automation tools. It goes without saying that the choice of the trading software is vital, as it will be one of the main factors that determines whether you are going to succeed or fail in the forex market. Even though forex is a comparatively new market for retail traders, it is one of the most technologically advanced. In terms of availability of these two platforms, Meta Trader still marks its presence in...

The growth of high-frequency (HFT) trading is one particular aspect of a broader trend in the foreign exchange market, brought about by advances in information technology and the spread of electronic trading. The advent of electronic broking/trading in the 1990s revolutionized the inter-dealer market. One of the defining characteristics that set high frequency trading players apart from other algo decisionmakers is the high speed with which they detect and act on profitable trading opportunities in the marketplace. High-frequency trading...

It's generally known that the safest and most profitable investments you can make on the Internet at the moment are the ones which are made in business of e-currency exchange. There are numbers of available electronic currencies for personal or business use on the Internet. And each of them competes with the others on the concepts of different options (loading the account and withdrawing from it). Most of electronic currencies are converted easily from, and to, and most of them have national currencies background. Simply put, e-currency...

These two terms are often heard on the forex market. Scalping and pipsing are kinds of trading strategies which are used by traders in order to make profits from the fluctuations of the currency courses within the day. Such orders are conducted in a very short period of time, sometimes even in several minutes. When you use this trading strategy your earnings from every order can be very small, but the whole profit can be high enough because of the big amount of the orders. Pipsing is considered to be very short term trading, which usually...