Many economists consider the non-farm payrolls (NFP) report out of the US as the biggest economic report each month. The Bureau of Labor Statistics (BLS), which is part of the US Department of Labor, releases the NFP report on the first Friday of each month. Economists expect tomorrow’s NFP report to show that the US economy added 312K jobs for October with an unemployment rate of 4.2%. The ADP Employment report which was released on Wednesday indicated the creation of 235K jobs in the private sector which beat estimates for the creation of 200K jobs. Dampening the upbeat report was the downward revision to September to 110K created jobs, 25K less than the initially reported figure of 135K.

While the ADP initially reported the creation of 135K private sector jobs, the NFP report showed the loss of 40K jobs in the private sector and the overall NFP headline figure indicated the US economy lost 33K jobs. This was attributed to hurricanes Harvey as well as Irma, but economists still predicted the creation of 80K jobs. This indicated a much weaker labor market than many accounted for, but the hurricanes were cited for the big miss which is why tomorrow’s expectations call for a rebound and a very strong figure.

Tomorrow’s expectations for private sector job growth are 300K job additions, but given the ADP’s downward revision to September it could fall well short. Should we see a weak figure tomorrow of below 200K job additions, then the USD may be in for a rough ride to the downside. September’s data missed by 113K jobs, but if we see a figure above 425K it would rectify the big miss last month and show that hurricanes were indeed to blame for the dismal September NFP report. In either case, the USD will be a very interesting trade during tomorrow’s trading session especially after the release of the October NFP report.

A miss for October will drop the USD as well as global equity markets as it will suggest that hurricanes were not the only culprit in a slowing labor market. Average hourly earnings should also be closely monitored. Expectations call for a monthly increase of 0.2% and an annualized rise of 2.7%. The US Fed is watching for signs of a pick-up in inflation, preferably on the wage front as massive stimulus is being tapered, interest rates raised and the central banks balance sheet set for reduction. For USD bulls, a lot will depend on tomorrow’s release and they need a very strong one in order to justify pushing the US currency higher.

Forex Profit Set-Up #1; Buy EURUSD - D1 Time-Frame

The most direct way to expose your account to tomorrow’s NFP report is by trading the EURUSD. Overall, the trend is higher and this currency pair could be well on its way to breach 1.2000 to the upside. A negative report is likely to see the EURUSD hugging the 1.1800 mark very fast while a positive surprise may have less of an impact to push this currency pair below the 1.1600 level. This would create a great long entry opportunity as this currency pair is currently trading inside of a support range and the CCI broke out above it -100 mark which created a bullish trading signal.

PaxForex offers great trading conditions for new traders as well as for experienced ones; a professional trading environment allows for more profits per trade.

Forex Profit Set-Up #1; Buy EURUSD - H4 Time-Frame

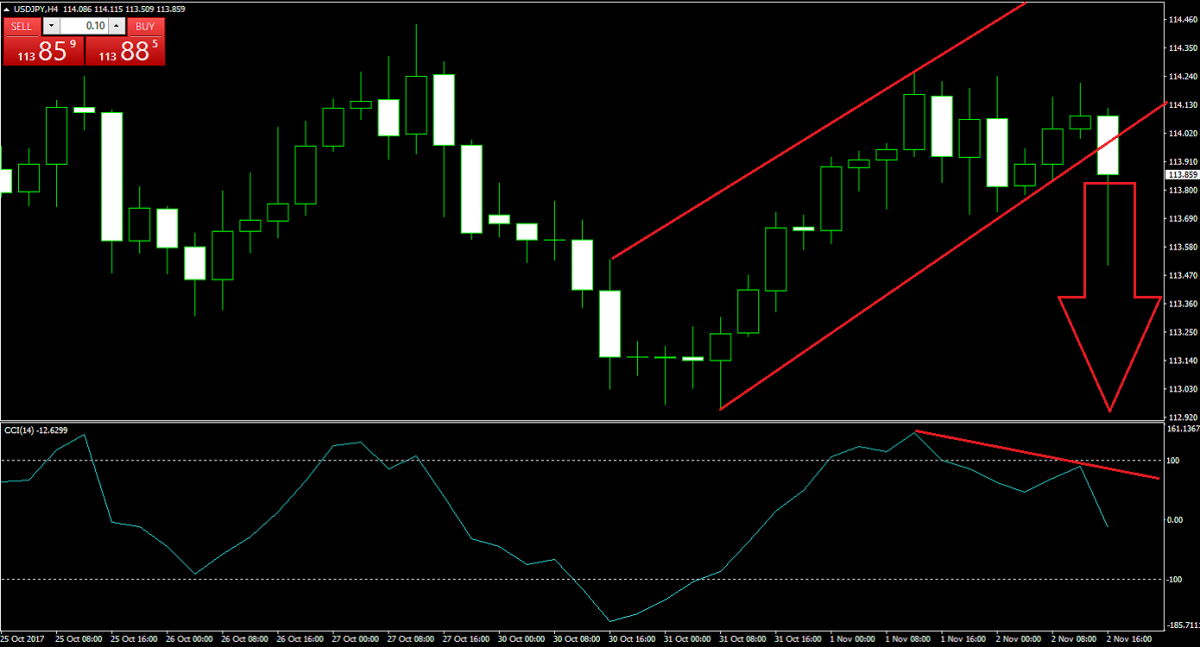

The USDJPY currency pair was trending higher inside of a bullish price channel, but today had a very bearish H4 candlestick result in a breakdown of the up-trend. Adding to the bearishness was the collapse of the CCI below 100. Forex traders should look for a retracement of the up-trend back down to the origin of the ascending support level of its bullish price channel at the 112.953 mark for a move of roughly 100 pips while the current upside remains limited. Again, tomorrow’s NFP report will be crucial so if you take this trade make sure you use tight stop loss orders.

How does a 100% deposit bonus sound for you and your account? Check out PaxForex’s bonus for each deposit which can further increase your profits as you may double each pip.

Forex Profit Set-Up #1; Buy Silver - H1 Time-Frame

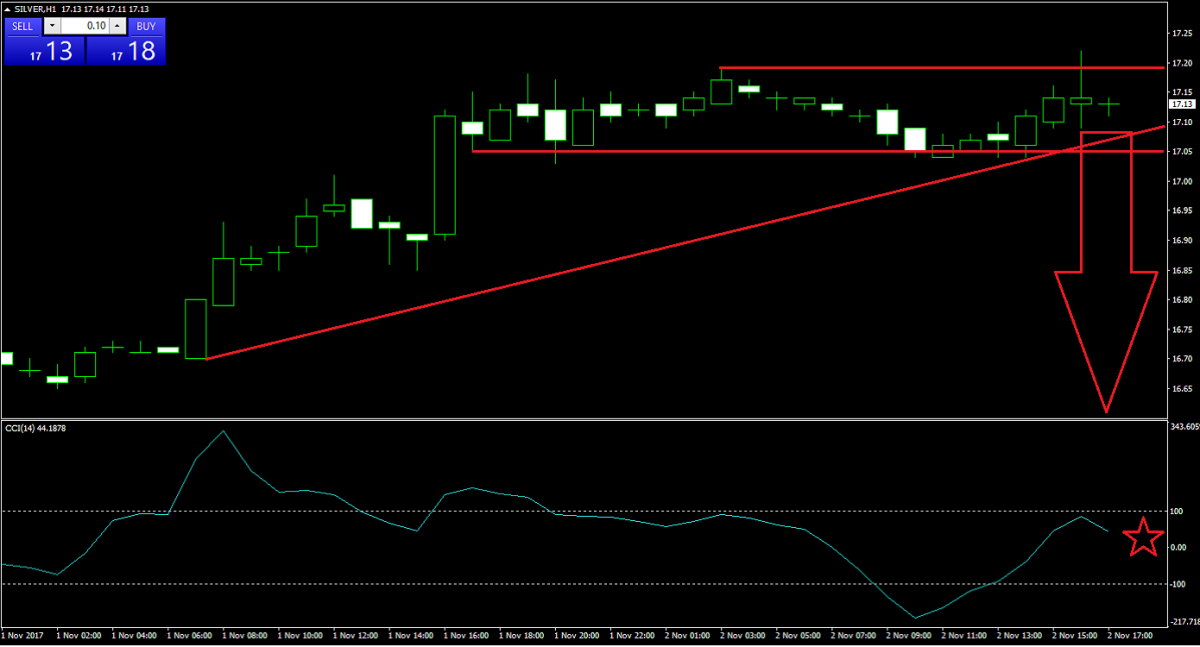

Forex trader’s can use Silver in order to hedge their forex portfolio heading into tomorrow’s trading session. Technically, this commodity should correct; it is currently trading inside of a resistance area which is further being pressured by an ascending support level. A breakdown from current levels should see Silver accelerate to the downside. The CCI is already trading below 100 and indicates a weakening bull case for this commodity to advance, unless tomorrow’s NFP report will clock in below 200K added jobs for October.

Silver’s upside remains limited and this commodity is vulnerable to profit taking which could take it back down to the 16.70 level from where price action should be monitored for a potential price action reversal. Open your PaxForex account now in order to take full advantage of tight spreads and fast execution.

To receive new articles instantly Subscribe to updates.