The European Central Bank (ECB) received another economic surprise today as the consumer price index (CPI) for September was released. Economists predicted the CPI to increase by 1.5% annualized, matching the rate of inflation which was reported for August. This is still short of the 2.0% inflation target set out by Mario Draghi and the ECB. The core CPI, which excludes volatile food and energy prices, rose an even smaller 0.9% annualized; this fell short of the 1.1% annualized increase expected by economists which would have matched August’s figure.

The ECB announced their QE taper last week, or QE recalibration as ECB President Mario Draghi likes to call it, but the absence of inflation is a big problem for the ECB. Today’s report did not only show the lac of inflationary pressures, but also a move in the wrong direction as inflation is slowing down. This surprised many economists as well as market watchers as the Eurozone economy is performing strongly. Economists believed that the stronger economic output would lift inflationary pressures which would give the ECB room to hike interest rates.

The Eurozone GDP expanded even more than previously expected. Today’s advanced third-quarter GDP figure showed an expansion rate of 0.6% quarterly and of 2.5% annualized. This compares to expectations for a quarterly growth rate of 0.5% and an annualized expansion of 2.4%. The previous report for the third-quarter was revised higher in order to reflect a quarterly increase of 0.7% while the annualized growth rate remained unchanged at 2.3%. The Euro initially weakened, especially as the lack of inflation and the decrease in inflationary pressures despite a stronger GDP report resulted in traders pushing back their rate hike expectations for the ECB.

While the US Federal Reserve and the European Central Bank decided to taper and recalibrate their massive QE stimulus, the Bank of Japan this morning diverged further with its monetary policy and decided to leave its stimulus in place at it current pace. The Bank of Japan Policy Balance Rate also remained unchanged at -0.10% and so did the 10-Year Yield Target at 0.00%. This matched what economists expected as well as the previous monetary policy announcement by the BOJ.

The Japanese Yen sold off after the announcement which was accompanied by mixed economic data, most notably the decline in household spending of 0.3% monthly for the month of September. Economists expected an increase of 0.6% monthly. Despite the stimulus in place by the Japanese central bank, consumers have not spent as the BOJ expected and the economy is faced with more deflationary pressures than inflationary pressures. The Japanese Yen is a favourite carry trade currency for forex traders thanks to its long-term low to negative interest rates with no end in sight for this ultra-lax monetary environment.

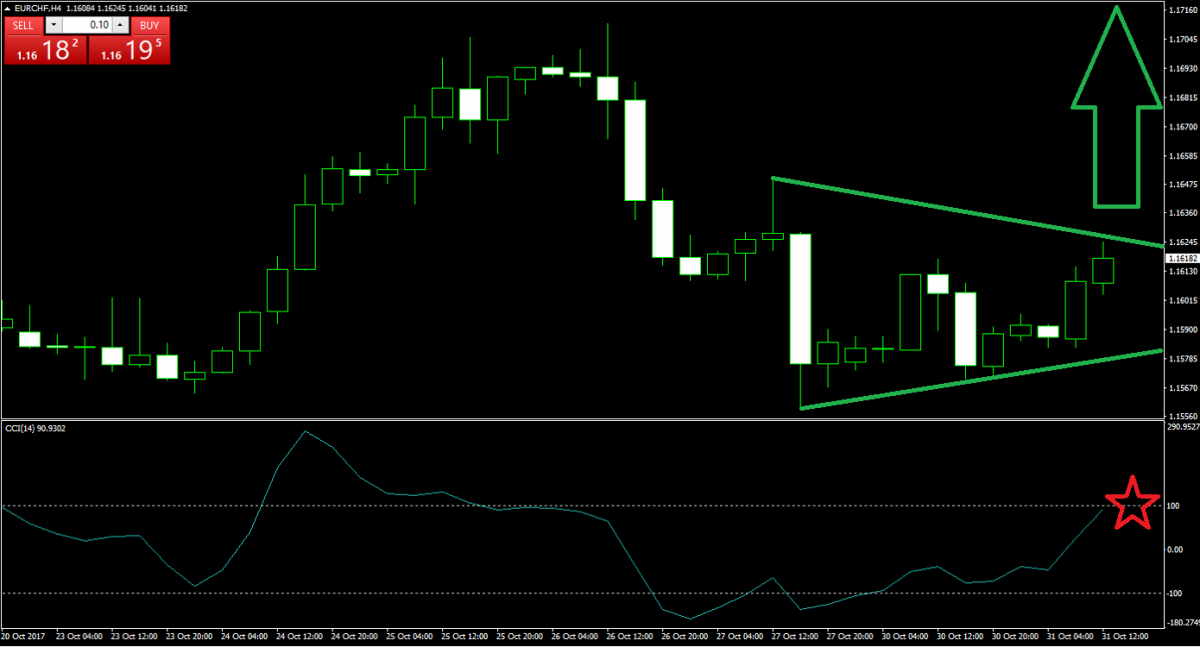

Forex Profit Set-Up #1; Buy EURCHF - H4 Time-Frame

The EURCHF is one great example of a Euro currency pair with great upside potential. The H4 chart indicates the formation of a symmetrical triangle which is a continuation pattern. Price action is currently near its descending resistance level and the CCI is approaching 100. Forex traders should use the next pull-back as a long-entry opportunity and but the EURCHF between the 1.1560 and 1.1590 level. There is plenty of upside potential in this currency pair.

Do you want to trade more lots with your portfolio, but lack the funds to do so? Make sure to check out the great deposit bonuses offered by PaxForex and boost your trading account right now in order to make more money from today’s recommendations.

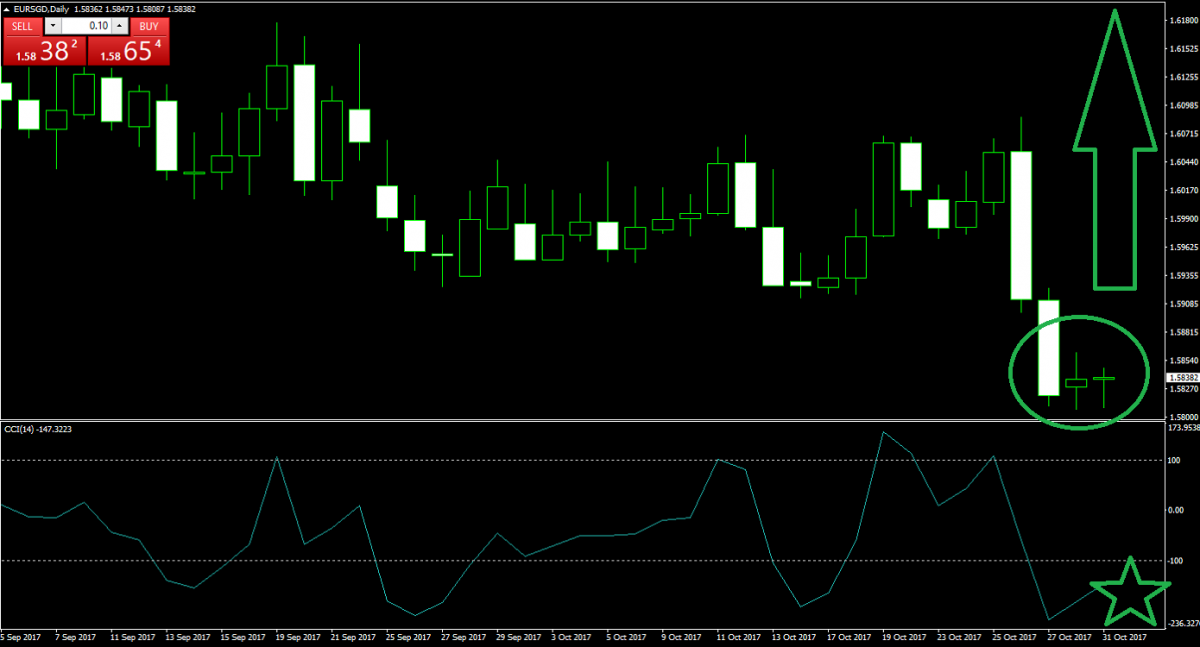

Forex Profit Set-Up #2; Buy EURSGD - D1 Time-Frame

A lot of forex traders want to crowd the major currency pairs and fail to overlook the great profit potential of minor currency pairs as well as exotic currency pairs. The EURSGD is one exotic pair which packs a one-two punch for buyers. As we already mentioned, the Euro is set to move higher which is the first part of our trade set-up. The Singapore Dollar was recently hit but the announcement that New Zealand will not allow foreigners to purchase homes which means that part of the TTP may have to be renegotiated and that the pact especially with Singapore needs to be worked on.

The last two candlesticks formed a star as well as a hammer after a correction which are bullish trading signals and the CCI is trading well below -100 which indicates an extreme oversold condition. We are looking for over 200 pips of upside in this currency pair. Enter this trade into your PaxForex account now and ride it to the top.

Forex Profit Set-Up #3; Buy CHFJPY - H4 Time-Frame

This trade is getting it clue from the dovish Bank of Japan as well as the rotation out of the EURCHF and into the CHFJPY as a result of our long trade in the EURCHF. A falling wedge formed on the H4 time -frame and gives us another bullish trading signal while a positive divergence in the CCI together with a level below -100 offer two more buy signals for the CHFJPY currency pair which has tremendous upside potential.

PaxForex offers great leverage which allows forex traders to earn more with their portfolio. Open your account today, fund it and apply for leverage which will accelerate your portfolio growth trade-by-trade.

To receive new articles instantly Subscribe to updates.