Yesterday Catalan President Puigdemont, shortly before the deadline expired to withdraw his pledge for an independent Catalonia and return to the rule of law as set out by the Spanish courts, notified Madrid and President Rajoy that if the Spanish government will push ahead with the triggering of Article 155 and the suspension of Catalan autonomy then he will declare unilateral independence. President Rajoy called for a special session in the Senate for Saturday in order to talk with the opposition party about steps required to trigger Article 155.

Global financial markets have been relative calm since the October 1st independence vote, which Madrid called illegal and without merits organized by anarchists. Volatility picked up during yesterday’s trading session as the situation gotten worse than markets have anticipated with the Madrid stock market as well as Spanish bonds under pressure, but the Euro remained relatively calm despite the rhetoric from both camps. Will the calm continue as traders man their desks on Monday morning?

The outcome or news after the special session on Saturday could lead to very hectic trading during the Asian trading session which may intensify come Monday morning in Europe. Instead of shying away from price action, forex traders should embrace the profit potential which open up during those times. We will take a look at three different ways forex traders can profit from what may unfold over next week’s trading session. Since the meeting in Madrid will occur on Saturday, it is wise to take the initial steps during today’s trading session. A little risk today can translate into a lot of pay tomorrow.

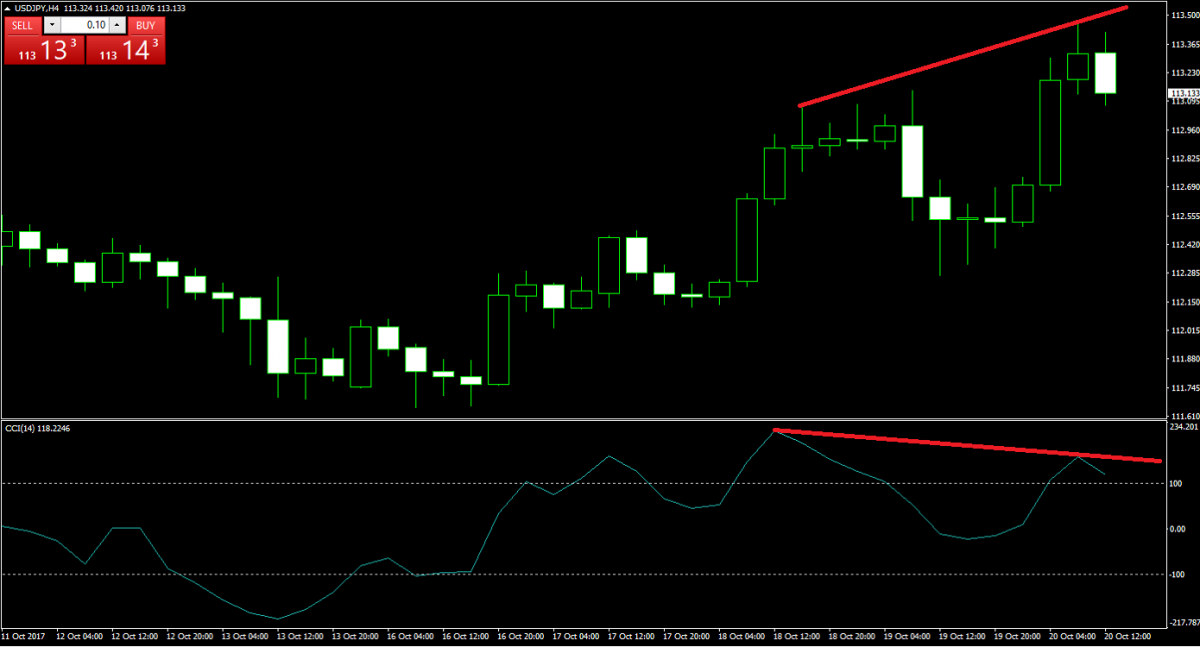

Forex Profit Set-Up #1; Sell USDJPY - H4 Time-Frame

Avoid direct exposure to what may happen over the next few days and weeks in Catalonia, the European Union and the Eurozone and take full advantage of one of the favourite safe havens during turbulent or uncertain times; the Japanese Yen.

Price action points towards a rally in the Japanese currency and the formation of a negative divergence give our sell signal even more validity. This currency pair has room to drop roughly 150 pips over the net few trading sessions as a combination of profit taking in the US Dollar will merge with new net long positions in the Japanese Yen, creating a perfect candidate for a move to the downside.

Forex Profit Set-Up #2; Buy Gold - H1 Time-Frame

When the trading environment becomes uncertain and political risks increase, traders also flock to Gold which performs better in a crisis environment than in a calm one. Given the risks of a rise in market volatility across asset classes, this trade will not only serve traders well over the weekend but can also act as a smart hedge in an overall forex portfolio.

Gold has already completed a breakout above a previous resistance level which has now turned into solid support. Any test of this level should be taken as an opportunity to go long this precious metal which currently enjoys attractive upside potential with minimal downside risk. Watch out for the 1,282.36 level and stagger your entries between 1,279.00 and 1,284.42.

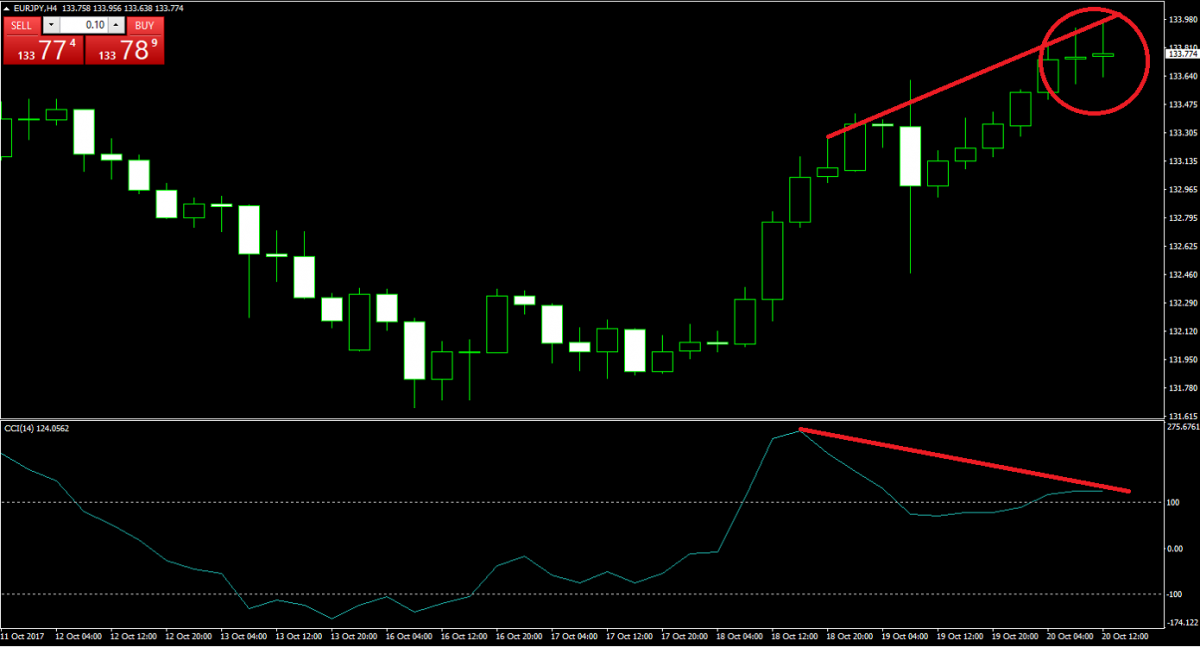

Forex Profit Set-Up #3; Sell EURJPY - H4 Time-Frame

This is for those traders who have the gut to more direct exposure and potential fall-out from tomorrow’s results and moving ahead. Here we combine the expected volatility of the Euro with the safe haven aspect of the Japanese Yen. This may limit the profit potential slightly, but is a prize worth paying for the downside protection of uncertainty.

A negative diversion form just as it did on the USDJPY and the last two candlesticks form a star formation at resistance which make this a triple sell signal. Forex traders are advised to split their entry orders over a 40 pips range between 133.600 and 134.000 and watch for the CCI to breakdown below 100 as a final confirmation for a move to the downside.

Make sure you log into your trading account with PaxForex if you already have one and if not open one before the trading day and its above outlined opportunities will pass. Those who miss this chance will look back on Monday with regret, waiting for the next chance. Don’t be afraid of volatility, be smart about it and embrace it. Happy profiting!

To receive new articles instantly Subscribe to updates.